https://youtu.be/FTrbHABBOuI

Cellphones. Internet. Music and movie streaming. Gaming. Apps. Your technology bills add up fast.

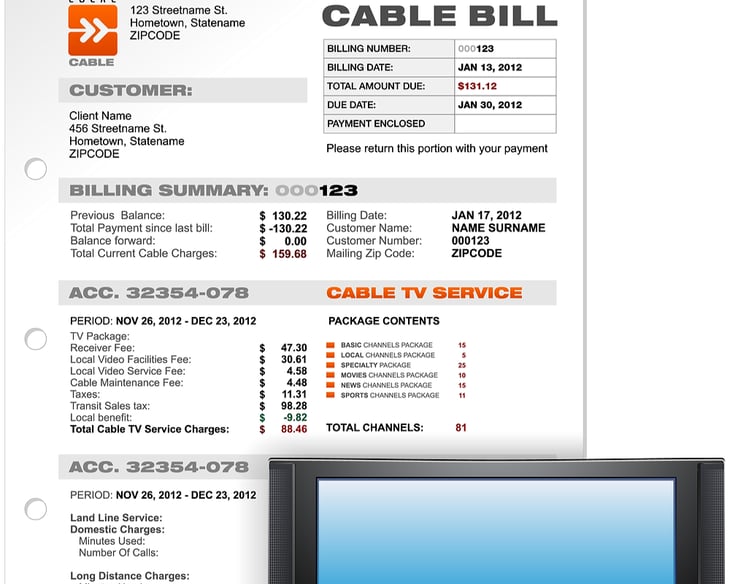

The average cable bill is $99 a month; a typical wireless bill for a family with four lines is $160.

Add seemingly small services like a Netflix subscription, Hulu Plus, Amazon Prime, SiriusXM and — for you gamers — Xbox Live, and there’s another $50 a month. Stream a couple of premium movies each week, it’s another $50 or more each month.

Then, of course, you have to figure in the cost of new devices, like a $120 Fitbit, a $150 Bose Bluetooth speaker, a $649 iPhone 7, a $149 Kindle Paperwhite, a $1,500 MacBook Pro or a $1,700 50-inch smart UHD flat-screen TV.

And how much are you spending on apps and in-app purchases? The average $35 a year?

Your technology bill soon may equal the food bill of a thrifty family of four — about $650 a month, according to USDA statistics.

Here are 10 ways to help you cut that bill in half.

No. 1: Buy, don’t rent, electronics and equipment

Rent-to-own electronics are a surefire way to pay too much — as much as three times the cost of whatever you’re buying is worth.

But what about those things you “have” to rent, like your cable or internet modem? Maybe you don’t realize you don’t have to rent them. You can buy your own.

It’s a secret the cable companies may not want you to know, and you probably don’t know. By some estimates, more than 90 percent of customers rent their modems. Comcast and Time Warner would like to keep collecting $10 a month without you being any the wiser, but you could go buy your own modem for around $50 and be done with the monthly fees forever. You should, however, make sure you’re using a modem approved by your cable operator (see Comcast, TWC, Cablevision, Charter and Cox‘s endorsements), says USA Today.

No. 2: Negotiate and buy only services you need

Sometimes when we sign up for a cable, internet or cellphone plan, we simply take what’s offered to us. It’s easier to say “sure” than to consider whether you really need that many movie channels, a sports package and DVR services.

Thoroughly examine your monthly bills and see what extra services you pay for but don’t use. For example, your phone plan may come with call waiting, call forwarding and three-way calling. If you never use those, see if there’s a cheaper package available without the added services. Are you buying too much bandwidth? Subscribing to premium channels you don’t watch? Cheaper plans may be available.

You may be able to negotiate a better cable and internet deal. Talk to your provider about waiving equipment fees or other charges. Find out how your current price compares with the price your company offers new customers.

No. 3: Choose the best cellphone deal

You may think that to get the latest and greatest phone, you need to sign a contract and stick with a particular carrier for two years. In reality, you can buy an unlocked phone and use it on almost any carrier, including low-cost prepaid plans.

Unlocked phones cost more upfront. Because you’re not signing a contract, you’ll have to pay the full retail price. Depending on the phone you want, that could cost a small fortune, but there are also plenty of reasonably priced unlocked phones available.

Even if you pay more for the phone upfront, you’ll save in the long run if you select a low-cost carrier.

No. 4: Wait for that upgrade

Speaking of phones, did you pounce on an iPhone 7 or the now-recalled Samsung Galaxy Note 7?

If you have lots of money to spend, there may be no reason not to buy the latest and greatest gadgets. On the flip side, if you’re trying to stretch your dollars, there is no reason to buy the latest and greatest gadgets.

Does your iPhone color matter? Do you plan to drop it in water? Then maybe you want the upgrade. Or maybe you never upgraded from an iPhone 5. You don’t have to buy the latest model; buying one generation back can save you money going forward. An iPhone 7 starts at $649; iPhone 6s, $549.

Will you really see a difference in picture quality in the 5-year-old 60 Hz flat screen TV you have now versus that newly advertised, $1,800 UHD 4K with 240 Hz? Consider that there’s not a lot of native 4K content yet, let alone refresh rates broadcast faster than 60 Hz?

Marketers spend a lot of time and money trying to convince you that your TV, computer, phone and whatever else you own is obsolete. They’re in the business of making sales. You should be in the business of protecting your money. Only upgrade when you truly need new technology, and don’t junk perfectly good items simply because something flashier comes along.

No. 5: Consider refurbished and open-box items

When it’s time to upgrade, don’t turn your back on the refurbished rack. Refurbished electronics can be every bit as good as brand-new items. And if you want to save a fast 10 to 15 percent on the latest toy, look for open-box specials. Many retailers offer discounts on product in less-than-perfect packaging. Just check that you’re getting all user manuals, power cords and other items needed to make your gadget run. There’s no sense in getting a deal if you can’t power up your gear when you get home.

Check out our earlier article devoted to buying refurbished items.

No. 6: Skip the extended warranty sometimes

Money Talks News financial expert Stacy Johnson takes a closer look at extended warranties, and you’ll definitely want to read his advice.

The bottom line is that while some items may benefit from a warranty, sometimes they’re simply a waste of money. It doesn’t matter if it only costs a few bucks; you could be throwing away money if you automatically say yes to every warranty offered, especially if you’re already getting coverage from a manufacturer warranty or from your credit card.

No. 7: More money may not mean better quality

Sometimes we spend our dollars in the wrong place. We may spend an arm and a leg for pricey versions of things such as HDMI cables, when the bargain-basement version does just as good a job.

According to savings site Brad’s Deals, these electronics categories are prime areas where you may be tempted to overspend:

- HDTVs

- Computers and tablets

- Cameras

- Smartphones

- Appliances

No. 8: Maximize your smartphone

Do you have a smartphone? Then you could probably ditch all sorts of extra expenses and gadgets from your life. Here are 20 ways to save with your smartphone.

For example, if you have a smartphone, there really may be no reason to pay for these:

- Landline service

- Long-distance service

- GPS

- Digital camera

Depending on how heavily you use the internet, you may even be able to use your smartphone as a hot spot in lieu of a separate home connection.

No. 9: Don’t leave everything plugged in

It might be a pain to unplug your electronics every night, but it could save you hundreds per year.

According to the U.S. Department of Energy, up to 10 percent of your energy bill could be going to items that are plugged in but turned off or, say, in the case of cellphone chargers, not in use. That’s because cords plugged into an outlet can be pulling power even if the electronic device it’s attached to is not on or being used. According to the government, you could be paying $43.46 per year to have a cable box with DVR plugged in 24/7.

The Lawrence Berkeley National Laboratory has a chart of average standby power usage so you can pinpoint what exactly might be the biggest drain in your house.

No. 10: Look for discounts

Finally, you’re spending way more on tech than you need to if you’re not waiting for sales or using a coupon.

For most of us, many tech items are a luxury, and that means we have the luxury of shopping around for the best deal. Other than impatience, there is little reason to buy an electronic item this instant. Practice delayed gratification, and wait to make your next big buy. Black Friday and Cyber Monday will be here shortly, bringing with them deep discounts on lots of tech products.

If you’re shopping outside the holiday season and don’t see a sale in the future, you can use these “15 Golden Rules to Save on Every Purchase” every day of the year.

Technology can be expensive, but it doesn’t have to break your budget. Use these 10 tips to start saving today.

What tech savings are you finding? Share with us in comments or on our Facebook page.

Jim Gold contributed to this post.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.