MTN Articles

The 10 Busiest Airports in the World (Half Are in the U.S.)

Half of the airports on this list are in the U.S. so you may be familiar with them.

10 Summer Essentials to Grab at Costco

Your fun-filled, budget-friendly season starts here.

7 Ways Your Life Should Change Before the Next Pandemic

The COVID-19 pandemic opened our eyes and taught us many lessons. A few need to stick if you plan to survive and thrive in the future.

Foreclosures Are Rising: 5 Places With the Most

Homeowners in some U.S. metros are struggling to keep up.

7 Tips for Healthy Turf With Grasscycling

This hack may seem lazy, but it really can be a great benefit to your lawn.

6 Tips to Invest Like an International Real Estate Pro

Avoid these common pitfalls when looking for overseas investment properties.

10 Programs That Help Struggling Retirees With Living Costs

Seniors may find some much-needed help with these programs.

Want to Protect Your Social Security Card? Never Do This to It

The federal government says this faux pas can invalidate your card.

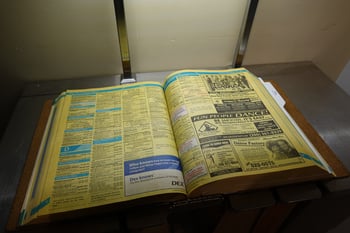

26 Things Babies Born in 2024 Will Never Know

How would you even explain it all to the newest generation?

13 Money-Saving Ways to Celebrate Earth Day Every Day

With these tips, sustainable living is great for the planet — and your bank account.

6 Ways to Stop Panicking About Retirement

You can keep calm and retire on with these key tips for your financial planning.

9 Things to Stop Buying for the Sake of Our Planet

Every day can be Earth Day if you change some of your shopping habits.

3 Hot Vintage Valuables That Might Be Hiding in Your Home

Home is where the haul is. What valuables are hiding in plain sight?

6 Surprising Benefits of Hearing Aids

They do more than improve your hearing.

10 Sleepy Towns Where Gen Z Is Snapping up Homes

Discover the tranquil havens that members of Generation Z might be transforming into hotspots.

5 Places Most Likely to See Home Prices Plunge in 2024

These cities face more than a 70% probability of seeing price declines in the next 12 months, according to a new report.

25 Hazardous Products That Were Recalled This Week

Foods, drugs, supplements, medical devices and other products get recalled more often than you might realize.

6 Foods High in Healthy Omega-3 Fatty Acids

Omega-3 fatty acids are essential to good health. Here’s how to get more in your diet.

Here’s a New Sign Car Insurance Prices Are Out of Control

Car insurance costs are rising much faster than inflation.

Money in a Minute for the Week Ending April 19

Here’s a quick look at the biggest financial news of the week.

1 - 20 of 18,674