Ever wish for a do-over? What if you could go back 15 years, and buy the right stocks at the right moment?

Fifteen years ago, in 2002, the stock market was in the doldrums. The terror attacks of Sept. 11, 2001, had badly shaken confidence, the tech bubble had burst, and the market had fallen to multiyear lows. In 2008, the market took another huge hit, finally bottoming in 2009. Since then markets have gradually recovered and now have soared to record heights.

Just in case you stumble across a time machine and set it for July 2002, here’s a list of stocks to take with you. Returns don’t include dividends, simply the increase in the value of the stock. Prices are based on the closing prices on July 30, 2002, and July 28, 2017.

15. Clean Harbors: 1,210 percent

Clean Harbors Inc. (CLH) specializes in environmental, energy and industrial services. It focuses on areas such as hazardous waste management, emergency spill response, industrial cleaning and recycling. In the past 15 years, the stock has risen 1,210 percent.

A $1,000 investment in 2002 would now be worth $13,100.

14. Activision Blizzard: 1,723 percent

Activision Blizzard Inc. (ATVI) has had a string of wildly popular video games over the past 15 years. They produce titles such as “World of Warcraft,” “Call of Duty” and last year’s smash hit “Overwatch,” games that even nongamers may be familiar with. They also bought the company that created the mobile hit “Candy Crush.” Their stock has gone up 1,723 percent over the past 15 years, so a $1,000 investment in 2002 would now be worth $18,230.

13. Nvidia: 2,938 percent

Nvidia Corp. (NVDA) makes graphics cards — the hardware that allows your computer to have cool-looking images when you play video games, watch videos or dabble in virtual reality. As the need for the company’s cards has grown, so has its stock. Over the past 15 years, Nvidia has had a return of 2,938 percent. Your $1,000 investment would now be worth $30,380.

12. Cal-Maine Foods: 3,615 percent

After the past few companies, Cal-Maine Foods Inc. (CALM) is refreshingly simple. It produces eggs. A simple, classic product and a solid business model has seen Cal-Maine return 3,615 percent over the past 15 years. A $1,000 investment would now be worth $37,150.

11. Usana Health Sciences: 3,626 percent

Usana Health Sciences Inc. (USNA) makes health supplements and sells them via a multilevel marketing strategy, in which people recruit others to sell products and get to keep a cut of their recruits’ sales. It has seen a share price increase of 3,626 percent, so $1,000 in 2002 would now be worth $37,260.

10. Deckers Outdoor Corp.: 4,308 percent

The footwear company Deckers Outdoor Corp. (DECK) produces fashion brands such as Ugg, and more active lifestyle brands like Teva and Sanuk. Fashion trends come and go, so it can be risky investing in of-the-moment brands. But over the past 15 years, Deckers would have been a good choice, bringing in a 4,308 percent return. A $1,000 investment in 2002 would now be worth $44,080.

9. Crown Castle International: 4,570 percent

Crown Castle International Corp. (CCI) is a major player in cellphone networks. They help manage, service and maintain cellphone towers, and also deploy small cell solution (SCS) networks in areas where a tower isn’t enough. Their stock return is certainly something to talk about: 4,570 percent over 15 years, so $1,000 invested in 2002 would now be worth $46,700.

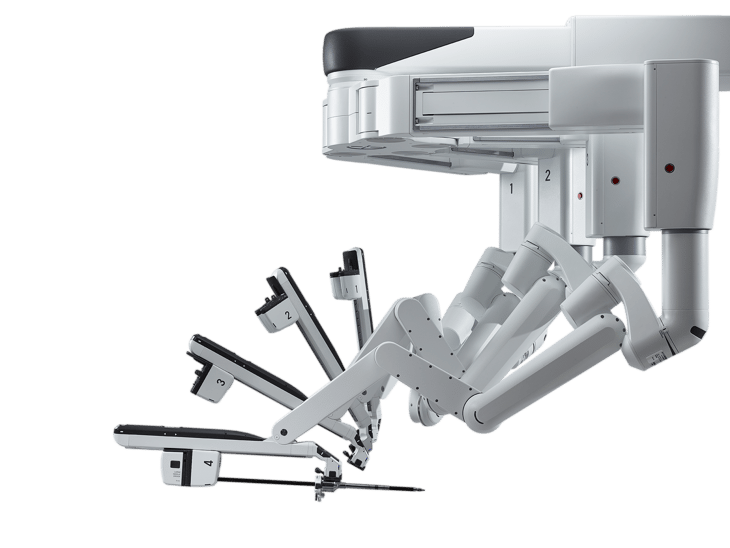

8. Intuitive Surgical: 6,775 percent

Intuitive Surgical Inc. (ISRG) is one of those companies you’ve probably never heard of, but you’ll be glad your doctor has. They make robotic surgical systems (including their flagship da Vinci system) that lets doctors do precise, complex surgery after making only a very small incision. Investors have gotten a 6,775 percent return. A $1,000 investment in 2002 would have turned into $68,750.

7. Amazon: 6,959 percent

Remember when Amazon.com Inc. (AMZN) was just an online bookstore? Now of course, the company’s website sells everything, manages to keep the post office running on Sundays, made its founder the world’s richest person (if only for a day or so), and even has a patent for a flying warehouse that will send you goods via drone. If you had the foresight to buy this behemoth back in 2002, you’d have been rewarded with a 6,959 percent return. A $1,000 investment would be worth $70,590.

6. Middleby: 9,393 percent

The Middleby Corp. (MIDD) lets investors get in on the surging popularity of eating out, without having to invest in a restaurant. The company manufactures cooking and food service equipment, under such brand names as Viking, Toastmaster, Star and a few dozen others. Middleby’s share prices have gone up by 9,393 percent; a $1,000 investment in 2002 would now be worth $94,930.

5. Illumina: 9,551 percent

Illumina Inc. (ILMN) is a biotech company that makes devices that do genetic sequencing. Its products can help find out if a person has a gene linked to a rare disease, provide insight for cancer research, help law enforcement with forensic analysis and more. Illumina’s stock value has climbed 9,551 percent, so $1,000 in 2002 would now be worth $96,510.

4. Apple: 13,490 percent

Back in 2002, Apple Inc. (AAPL) mostly made laptop and desktop computers. It was, at best, a niche company with only a 3 percent share of the computer market. Its stock traded at split-adjusted price of $1.10. Two years later, Apple’s CEO had an idea for a phone, and in 2007, the iPhone pretty much changed the world.

After building a better mousetrap (and throwing in an iPad, the thing no one knew they wanted, to boot), Apple has become the most valuable publicly traded company in the world. Its shares have gone up in value by 13,490 percent. A $1,000 investment in 2002 would now be worth $135,900.

3. Priceline: 16,577 percent

The Priceline Group Inc. (PCLN) is a family of websites — including Priceline.com, Kayak.com, Hotels.com, Open Table and others — that helps people find low prices on travel purchases such as food, lodging and airfare.

We’ll never know for sure if pitchman William Shatner was the magic ingredient in helping its value explode over the past 15 years, but it’s gone up a stellar 16,577 percent. A $1,000 investment in 2002 would now be worth $166,770.

2. Netflix: 20,124 percent

In 2002, Netflix Inc. (NFLX) would send you a DVD in a red envelope. You’d pay a few bucks a month, but there were no late fees, and you didn’t need to go to a video store anymore. Its split-adjusted share price that year was 91 cents.

In 2007, Netflix started streaming video online, eliminating the need for envelopes. In 2013, it started making its own content, creating shows such as “House of Cards,” “Stranger Things” and “13 Reasons Why,” each of which became a cultural phenomenon.

Netflix video streaming is estimated to account for more than one-third of all internet traffic during peak hours. The stock price has gone up by 20,124 percent since 2002, so a $1,000 investment then would now be worth $202,240.

1. Monster Beverage: 66,200 percent

There was a time when “energy drink” meant black coffee. But like some of the other companies on this list, Monster Beverage Corp. (MNST) succeeded by creating a product people didn’t even know they wanted. Their returns are certainly eye-opening: 66,200 percent since 2002. A $1,000 investment then would now be worth $663,000.

What share trades have you made that you now celebrate — or regret? Share with us in comments below or on our Facebook page.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.