Every January, we vow to get our financial houses in order. And each December, we face up to the reality that we didn’t quite make it happen.

There are plenty of reasons why we fail on our financial resolutions, including the biggest reason of all: too little time.

This year, try a new approach. Divide the job into bite-sized tasks and tackle one a day for a month.

Ready to get started? Let’s do it!

Day 1: Schedule time

As you begin, set yourself up for success.

It’s easy to fall into a habit of skipping one day of your financial tasks, intending to catch up the next.

But that’s dangerous. Don’t do it. Your first task is: Take out your calendar and schedule a time each day to work on your plan. Stay flexible. If 10 a.m. works one day and not the next, shift it. Just block out 30 minutes per day.

Day 2: Reflect on past missteps

Spend time reviewing last year’s financial missteps. This will help you to avoid repeating them.

Did you make an unrealistic budget? Did you spend too much on clothes, travel and other extras? Buy a new car or pay a high interest rate?

Sit down with your checkbook, bank statements and other financial documents and ask yourself the hard questions to get a picture of what needs to be done.

Day 3: Spell out your financial goals

Think over your short- and long-term financial goals. Write them down and prioritize them.

Will you save enough to make a down payment on a new house? Pay off credit card debt? Shore up your retirement savings?

First, think of your big and long-term goals. Next, set short- and medium-term milestones to hit to get there.

If you have a spouse or partner, do this together so you’re working toward the same goals.

Set a reminder on your calendar to check on your progress regularly — say, every two or three months.

Day 4: Share your goals

If you share your goals with family, friends and others, you are more likely to achieve them.

Verbalizing goals helps you fine-tune and visualize. Others may offer suggestions and encouragement.

Check out: “10 Characteristics of Wildly Successful People.”

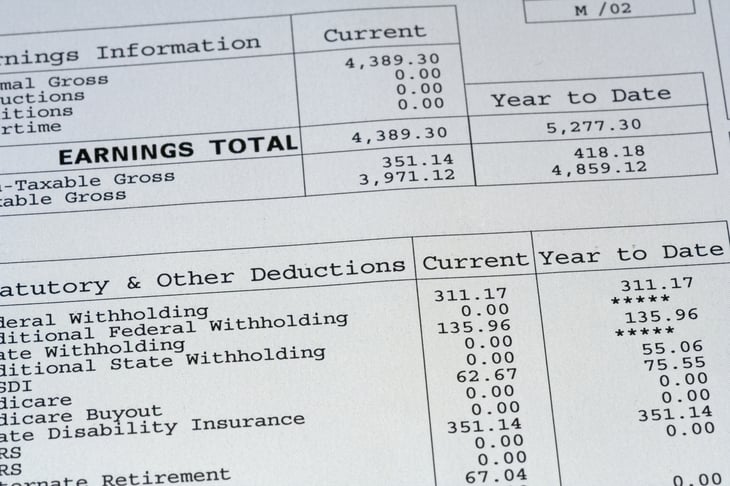

Day 5: Get to know your paycheck

You probably know the gross amount you earn with each paycheck. But that’s just one piece of it.

Scrutinize your pay stub. Understand the monthly deductions. What are you paying for insurance? Income taxes? Contributing to a 401(k)?

The answers will help you understand what you have to work with and make decisions.

Day 6: Meet with HR to talk about benefits and options

Benefits and options offered by employers change over time. If you’re like many people, you’ve ignored some of those memos from human resources.

Make a date to meet with your company’s HR representative to learn what benefits are new, have changed or that you may be missing — for example, a child-care subsidy, help with tuition or benefits for same-sex partners.

With a 401(k), are you setting aside at least enough to get the company’s maximum matching funds? (If not, you’re leaving free money on the table.)

Review your personal information to be sure it’s current, including beneficiaries for life insurance and other policies. Some changes can’t be made immediately. Add your company’s next open enrollment to your calendar to prompt yourself to follow up.

Day 7: Review your credit

A credit score is the figure that banks, merchants and other lenders use to determine the risk of lending to you. To understand your borrowing potential, check your credit score (it costs nothing) and review your credit report (also free) to find any errors that could damage your score.

The most common scoring system is the FICO score. Scores range from 300 to a perfect 850.

Check out: “7 Ways to Raise Your Credit Score Fast.”

Day 8: Start tracking your expenses

Now it’s time to understand where your money is going.

Start by looking at all the expenses you’ve paid for in a month. Use your bank and credit card statements as starting points.

Adopt one of the great expense tracking tools — like our partner YNAB (You Need a Budget). Or use the free Google budget template.

Check out: “9 Overlooked Expenses That Ruin Your Budget.”

Day 9: Find ways to lower monthly utility bills

Are you in the habit of automatically paying utility bills each month without much thought?

Think about them now. Ask yourself: Can I save by turning the heat down a degree or two in winter? Must the air conditioning be turned on every day in summer?

Check out:

- “How to Slash Every Monthly Bill You Have.”

- “19 Ways to Lower Your Utility Bills While Hunkered Down.”

Day 10: Review your cellphone plan for savings

The cellphone bill is a regular monthly expense, but maybe it was one of those costs you overlooked when reviewing expenses.

Take a look now with an eye to finding savings. Do you and other family members really need a new phone every year? Are you on the most cost-effective plan, or has inertia kept you from finding a better plan?

Check out: “2 New Ways to Slash Your Cellphone Bill.”

Day 11: Cut your cable TV expense

There are so many options for entertainment now that cable television service is one area where most of us can cut costs — and still have an amazing number of entertainment and news programs available to us.

Take a look at your online streaming options — Philo, Amazon’s Prime Video, CBS All Access and Hulu, to name a few — and consider cutting the cable cord (and your TV bill).

Check out:

- “4 Streaming TV Services That Cost $20 a Month — or Less.”

- “15 Free Streaming Services to Watch While Stuck at Home.”

Day 12: Set up an emergency fund

Do you have readily accessible funds that you can use in case of an emergency?

Some 47% of Americans have run through their emergency savings funds, finds a recent survey of 2,000 individuals by Highland, a financial consulting company.

Of those surveyed, 67% told the pollsters they regret not having saved more for emergencies before the pandemic crisis began.

In all, 82% said they wouldn’t have the funds to cover a surprise expense of $500 right now.

Start right now setting aside even a little money in an emergency account. Money Talks News founder Stacy Johnson recommends three steps to get started.

Day 13: Comparison shop for your insurance policies

Many people are surprised to realize that they are wasting money on insurance premiums. Buy only the insurance your truly need.

Comparison shopping for insurance has become streamlined and much simpler with sites like Money Talks News partners Policygenius, The Zebra, Gabi, MetroMile and others.

Check out: “New Ways to Save Money on Insurance of Every Kind.”

Day 14: Create a realistic budget

When it comes to creating a spending plan (also known as a budget), the idea is to control your spending, but in a realistic way.

Only when you know where your money already is going can you stop living paycheck to paycheck and start effectively planning for expenses. A good option: Budget software YNAB (for You Need a Budget), a Money Talks News partner.

Check out: “An Easy Way to Track Your Spending and Build Your Savings.”

Day 15: Review your expenses

It’s been a week, now, since you starting tracking your expenses — time to see where your money is going. Have you been surprised by your true spending compared with the amount you’d thought you were spending?

It sounds like a pain to regularly review your spending, but, really, it’s no big deal. If you’ve been collecting the data, looking at it takes just a few minutes.

Make this practice a new habit. This is how to make certain you are allocating money to really accomplish your goals.

Check out: “11 Tips and Tricks That Will Keep You From Overspending.”

Day 16: Rein in impulse buying

It’s tough to resist the siren call of a 50%-off sale, especially if you’ve had a bad day or want to treat yourself. These alerts are designed to push the buttons of impulse shoppers.

Go through your email alerts and, unless one is vitally important — a reminder to refill medications, for example — unsubscribe.

Check out: “8 Signs You Have a Shopping Addiction.”

Day 17: Make a plan to tackle debt

Look at your debts — car loans, credit card balances, mortgages — and see how much interest you are paying.

Make a plan to pay them off. There are several ways to do it. One is to direct extra money toward debts with the highest interest rates. With another, the debt snowball method, you attack debts with the lowest balances first.

If you routinely invest or save, but carry heavy high-interest debt, consider tapping savings to cut some debt. Look into refinancing the mortgage or other debts if you can lower the interest rates.

If you are struggling under unmanageable debt, there’s free help at our Solutions Center.

Check out: “8 Surefire Ways to Get Rid of Debt ASAP.”

Day 18: Review your credit cards

Are the credit cards you carry still the best ones for you? Do you need them all? Take them out and compare interest rates and fees.

Make it your goal to pay off any card balance monthly.

If you carry no balance, comparison shop for cards with the best rewards. If you do carry a balance, use cards with the lowest rates.

Day 19: Review and rebalance retirement savings

Get a grip on your retirement accounts. If you’ve lost track of any of them, gather information from past and current employers and list each account and its balance in one place for quick review.

In general, younger workers should hold a greater proportion of stocks, as they have more earning potential but greater risk. As you grow older, shift the balance gradually toward a greater share of lower-risk investments, such as bonds.

Check out:

Day 20: Get a grip on your Social Security benefits

No matter your age, understanding and planning for Social Security is crucial to financial security. Your decisions now can affect your retirement checks.

Set up a free MySocialSecurity account. Simply having the online account with the Social Security Administration (SSA) helps safeguard your Social Security number from identity thieves. You’ll see statements showing your retirement benefits and when you’ll be eligible.

If you plan to quit work the instant you turn 62 (the minimum age for claiming Social Security), it’s worth at least learning what you’d gain by working a bit longer.

Waiting until your full retirement age as set by the SSA — 66 for most Americans — can mean bigger benefit checks. Waiting until after 66 can supersize your benefit checks.

Also, have a strategy. For example, maybe claiming spousal benefits first, while your own benefits grow, would pay off.

For a small fee, Money Talks News partners Social Security Choices will analyze your benefits and recommend a strategy for claiming.

Check out: “Millions of Americans Ignore This Free Retirement Planning Tool.”

Day 21: Review your bank accounts

Do you receive the highest interest and most benefits possible from your checking and savings accounts?

Do you routinely research interest rates and roll over your CDs to ensure you earn the highest interest possible?

Choose a bank that helps you save and earn the most interest on your money without high fees.

Check out: “10 Tips to Get More Bang From Your Bank.”

Day 22: Incorporate money savers and freebies

If you’re not routinely using some of the digital tools for saving money, you’re probably paying too much.

Sign up for cash-back and shopping discount sites like Rakuten, Swagbucks, Ibotta and TopCashback. Next, sign up for more discounts with Honey, Raise and Restaurant.com for savings on everything from laundry detergent and meals to caviar.

Check out: “5 Tricks to Get Discounts on Everything You Buy in Stores.”

Day 23: Search for missing money

Forgotten bank accounts, unclaimed wages and forgotten utility deposits are just some of the funds you may not be aware that you can easily claim.

Start with Missing Money, a database of unclaimed government money, to identify cash you may be able to claim.

Beware of scammers, of course. But there several legitimate places to check for lost treasure, including the Federal Deposit Insurance Corporation (FDIC), the U.S. Department of the Treasury and USA.Gov.

Check out: “7 Ways to Find Your Unclaimed Money.”

Day 24: Sell gently used items

We all eventually grow tired of our appliances, furniture and clothes. You can toss or donate them. Or, spend this day’s 30 minutes to check which things you can sell, online or in consignment shops.

Swap.com lets you consign clothing. At Gazelle, you can buy and sell used electronics. Also, ask your cellphone provider if they have a buyback program for equipment.

Schedule a day to gather your unused stuff to sell, another day to find the best places to do it and a third to list the sales or deliver things to a brick-and-mortar consignment shop.

Check out: “6 Safe Ways to Sell Your Clutter During the Pandemic.”

Day 25: Buy gently used items

Lovers of designer duds know of a host of online sites and consignment shops offering gently used items for a fraction of the original cost.

Bag, Borrow or Steal has great bargains on high-end handbags, shoes and other luxury goods. Don’t stop there. Think big. Do you need new dining room chairs? Shop Habitat for Humanity’s ReStores, search yard sales and look online to find what you want at a fraction of retail prices.

Check out: “9 Companies That Sell Your Stuff For You.”

Day 26: Consider a second job

Now that you have identified your resources and financial goals, you may realize you need to earn extra cash. A second job is a possibility. Or you might be able to turn a hobby into a semi-professional paying opportunity.

Many fine artists also photograph weddings and other celebratory events. Nurses and other medical professionals may take shifts at doctor’s offices and other facilities.

When the pandemic abates, you might enjoy walking dogs or offering tours of your hometown to visitors.

Check out: “50 Ways to Make a Fast $50 (or Lots More!).”

Day 27: Gather tax documents

Get ready for tax time by collecting all the documents you’ll need in one place.

Do you have receipts from charitable donations? If you have an income that is not on your pay stub — like rental income or money from a side job — put it in the file.

Keep an eye out for tax documents from your employer and your investments and retirement plan so you can file them easily and ease the burden of tax time.

Check out: “12 Expenses You May Be Tempted to Claim as Tax Deductions — but Shouldn’t.”

Day 28: Identify tax-lowering moves

In the first few months of the year, there’s still time to take to lower your tax burden.

If you have a 401(k), make sure you have contributed the maximum amount that can be deducted from your taxable income. If not, catch up.

These retirement savings contributions, as well as charitable gifts and many business expenses for self-employment, still may be used as tax deductions for last year even when made in the first months of the new year.

Check out: “10 Ways Your Taxes Will Change in 2021.”

Day 29: Create or update estate documents

Drawing up a will and other end-of-life documents is a gift you can give your loved ones. It also can bring you peace of mind.

You’ll save your heirs money and anguish by preventing the costs and conflicts often incurred when unsettled end-of-life issues must be negotiated among survivors.

Several online legal companies offer free forms and information. One is Money Talks News partner RocketLawyer, which has forms for a Last Will and Testament, estate planning, living will, healthcare power of attorney and durable power of attorney. If you already have these documents in place, take a moment to review them and ensure they are up to date, accounting for changes like marriage and divorce.

Check out: “8 Documents That Are Essential to Planning Your Estate.”

Day 30: Ask for help

There’s no shame in seeking financial planning help.

If you can’t follow your budget, don’t understand taxes, are unsure about your savings or don’t have a plan to meet financial goals, get trustworthy financial help.

As you no doubt realize, these areas are rife with imposters and scammers, so choose consultants and advisers carefully. when choosing a financial adviser, work only with a fiduciary, a professional who is required to put your financial interest ahead of their own.

Check out: “3 Steps to Finding the Perfect Financial Adviser.”

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.