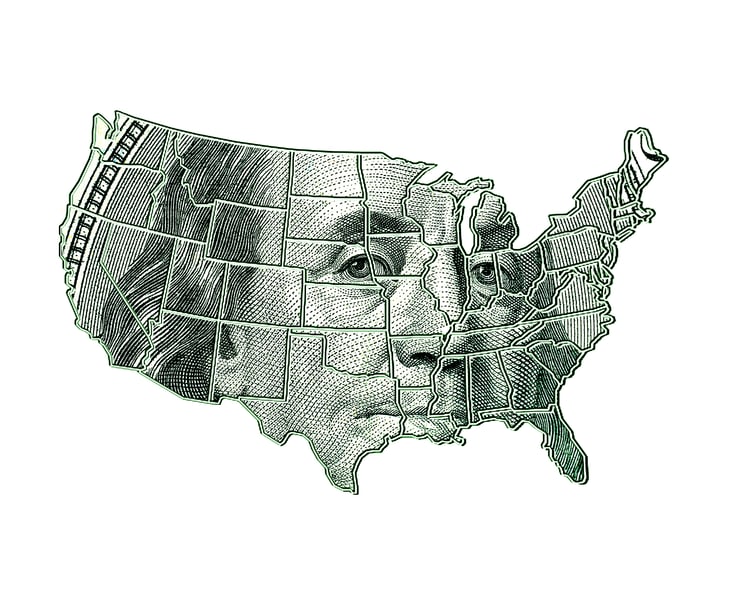

States and their residents receive money from the federal government in a number of ways, from the Medicaid health insurance program to unemployment insurance.

Americans’ dependence on government assistance had been decreasing, but this year, the coronavirus pandemic has driven up federal spending to states, says WalletHub’s 2020 list of states that are most and least dependent on federal funds.

What follows are the five most-dependent states and the five most-independent states.

The ratings show a state’s dependency score from WalletHub. The scores take into account residents’ dependence on federal money and the state government’s dependency. The lower the score, the less a state depends on federal money.

No. 5 most-dependent state: Montana

Total dependency score: 70.78 of 100 points

Montana ranks among the states receiving the most money from federal grants compared with the federal taxes its residents pay.

The state has been singled out as one of the best states for people with low incomes due to its relatively low taxes.

No. 4 most-dependent: West Virginia

Total dependency score: 73.86 of 100 points

West Virginia has suffered economically for some time. Some counties are seeing a recovery, but improvements have been largely concentrated in a few limited areas.

About 53% of the state’s working adults are unemployed or have stopped looking for work. Experts say workers in the state lack the education needed to compete, and that drug use among some residents compounds the problem.

No. 3 most-dependent: Mississippi

Total dependency score: 77.02 of 100 points

Mississippi’s state government is more reliant on federal funding than any other, WalletHub says. In fact, 43.4% of the state’s general revenue is from federal aid, according to the nonpartisan Tax Foundation’s 2020 analysis.

The state ranks among the highest for the amount of federal income received versus the federal taxes its residents pay.

No. 2 most-dependent: Kentucky

Total dependency score: 78.18 of 100 points

About 1 in 8 Kentuckians (12%) qualify for SNAP benefits, compared with about 1 in 9 people nationally.

After the state reinstated work (or volunteer) requirements for SNAP benefits in late 2018, some 10,000 low-income people lost federal food assistance, according to the Associated Press.

No. 1 most-dependent: New Mexico

Total dependency score: 85.8 of 100 points

About 1 in 5 people (21%) in New Mexico use SNAP benefits, according to the latest data.

In addition to this high rate of food insecurity, the state also relies heavily on federal funding for state operations, with about 40.6% of New Mexico’s general revenues flowing from Washington, D.C., according to the Tax Foundation.

These facts contribute to making New Mexico the most federally dependent state.

No. 5 most-independent: Utah

Total dependency score: 17.83 of 100 points

Only about 1 in 19 (5%) of Utah’s residents need SNAP food assistance. A relatively small share of residents — 9% — live under the poverty line, according to SNAP data.

These comparatively low numbers mean that the state relies less on federal dollars to help its residents get by. In addition, state government here receives just 24.2% of its general revenue from federal sources, says the Tax Foundation.

No. 4 most-independent: Iowa

Total dependency score: 16.53 of 100 points

In Iowa, 29.4% of the state’s general revenue is from federal sources, the Tax Foundation’s 2020 report finds.

One in 10 (10%) of Iowans qualify for food assistance from the SNAP program.

Pay for Iowa teachers is in about the middle of the pack in this study of teacher compensation: “Here’s How Much Teachers Are Paid in Every State.”

No. 3 most-independent: Delaware

Total dependency score: 14.91 out of 100 points

A relatively low 27.2% of Delaware’s general revenues come from federal government.

The state has been singled out as one of the best for people with low incomes due to its relatively low taxes. Delaware’s total tax burden as a percentage of income is 5.24%, compared with 14.59% in Washington state, where the total tax burden is highest.

No. 2 most-independent: New Jersey

Total dependency score: 14.52 of 100 points

New Jersey doesn’t rely heavily on federal government aid, which brings in just 28.4% of the state’s general revenues.

About 1 in 13 residents — or 8% — need SNAP benefits.

No. 1 most independent: Kansas

Total dependency score: 12.73 of 100 points

Kansas doesn’t use much money from the federal government. About 1 in 14 (7%) of residents need SNAP benefits, and a relatively modest 23.3% of state general revenue comes from the federal government.

Kansas City — in Kansas and Missouri — recently was named one of “The 15 Best Cities in America for Saving Money.” Cities were scored for their unemployment rates, housing costs and per-capita incomes.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.