The IRS says it has begun increasing audits on taxpayers, and even those of modest means have more reason to worry that their returns might be flagged.

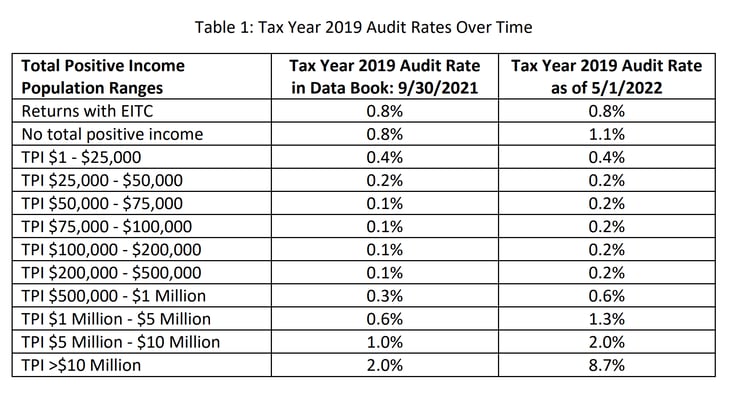

Recently, the IRS announced that audits on tax returns dating from 2019 greatly increased from October 2021 through April 2022. The federal agency notes that during that time span, such audits doubled for “every income category above $100,000.”

But a closer look at the numbers shows that audits actually have doubled for folks making more than $50,000. An IRS spokesperson confirmed this to Money Talks News.

The audit figures are based on what is known as total positive income (TPI). According to the IRS, TPI is “the sum of all positive amounts shown for the various sources of income reported on the individual tax return and, therefore, excludes losses.”

The IRS notes that the audit rates in Table 1 “are merely a ‘snapshot’ in time” and thus will change as open audits are completed and new audits are started. These numbers also might be low because as of Sept. 30, 2021, the agency had started “relatively few” 2019 audits.

Still, while the IRS is highlighting its audits of individuals and businesses of high net worth, these numbers should serve as a reminder that taxpayers of all income levels can and do get audited.

For example, taxpayers who claim the earned income tax credit (EITC) — a valuable tax break for workers with low or moderate incomes — tend to be more likely to get audited. The Taxpayer Advocate Service reported in April that in recent years the IRS has audited about 1% of returns that claimed the EITC.

Overall audit rates still remain quite low, though. The IRS notes that “resource constraints limit the work that the agency is able to do.”

It goes on to say that with just 6,500 frontline revenue agents to do the audit work, enforcement activity levels against “global high net-worth individuals, large corporations, and complex structures like partnerships are far lower than in the past.”

Indeed, a second IRS chart (“Table 2: Audit Rates Over Time”) shows that audit rates for individuals and corporations of all income levels dropped sharply between the 2010 and 2017 tax years. Rates fell especially steeply for individuals with TPIs of $200,000 or more during that period.

Trying to get a jump-start on planning for next year’s tax season? Check out “17 Ways Your Income Taxes Will Be Different in 2023.”

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.