Funding your retirement is intimidating. Many of us feel ill-equipped to manage our money, making the job especially difficult. And yet for most people, there’s no choice. Like it or not, our ability to live comfortably in old age is up to us. Our futures depend on what we do today and tomorrow.

If you want to dive deeply into it, retirement saving and investing can be complex. But most of us aren’t interested in becoming experts. For a simple, manageable approach, check out these five steps:

Step 1: Use your age to decide what to put in stocks

Over time, stocks have produced higher returns. As financial product ads warn, past performance doesn’t predict future results. But it is likely that stock market values will continue to grow over time.

Retirement savers often invest in stocks by buying stock mutual funds. Investors sometimes use a rule of thumb to decide how much of their portfolio to put in stocks. Money Talks News founder Stacy Johnson favors this formula:

- Subtract your age from 100.

- Invest the difference as a percentage in stocks.

How it works: If you’re 45, subtract 45 from 100, which leaves 55. Invest 55 percent of your portfolio in stocks.

Another formula suggests using the number 110. So, in that case, a 45-year-old would have 65 percent of his or her money in stocks.

You get the idea. The only trick is to choose the equation that you think is most closely aligned with your health and family history — in other words, your life expectancy — and tolerance for risk.

Step 2: Find your tolerance for risk

Investing in stocks arguably offers the best chance for growing your money, but it also involves more risk. In general, the stock market has been climbing since the end of the latest recession, but it can be a gut-churning ride.

Here’s the puzzle retirement savers face: If you keep all of your money in cash or low-risk investments, you’ll earn practically nothing. You may even lose money to inflation. By contrast, taking more risk can mean a chance for higher returns — and a greater chance of losing money, at least in the short term.

Understanding your tolerance for risk helps you decide how to invest and lets you sleep well at night. If you have questions about your risk tolerance, you might want to seek a financial adviser and get some guidance.

Step 3: Pick a stock fund

Many investors prefer a simple way to invest: They buy shares of index funds, which are often managed by computers. These mimic the performance of a particular group of stocks or bonds. The Vanguard 500 Index Fund, for example, mimics the performance of Standard & Poor’s 500 stock index. Index funds are cheaper to own than managed funds, which human experts manage, and their track record is as good as, or better than, most managed funds.

A report in the New York Times cited a series of annual S&P Dow Jones studies that found “that over extended periods, the average actively managed fund lags the average index fund.” Some active managers do better than index funds, but it’s hard for most of them to maintain that edge over time, the report says.

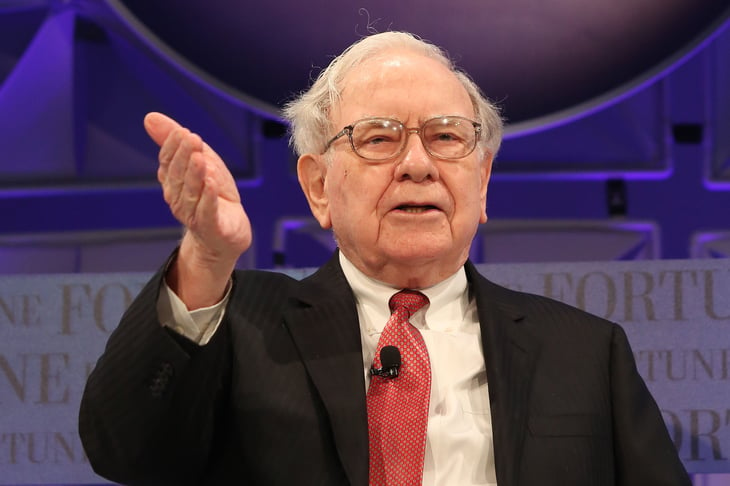

Index fund balances soared in spring 2014 when legendary investor Warren Buffett disclosed publicly that he wants most of his money put in a stock index fund after he dies. The Wall Street Journal said:

Mr. Buffett, 83 years old and with a net worth of $66 billion, wrote that he advised his trustee to “put 10 percent of the cash in short-term government bonds and 90 percent in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.)”

Step 4: Diversify

A carefully chosen diverse set of investments helps you protect against or at least soften losses from stocks. The U.S. Securities and Exchange Commission says:

The practice of spreading money among different investments to reduce risk is known as diversification. By picking the right group of investments, you may be able to limit your losses and reduce the fluctuations of investment returns without sacrificing too much potential gain.

For the remainder of your portfolio after your stock market investments, Money Talks News founder Stacy Johnson suggests dividing it in half:

- Put half the money into a low-cost intermediate bond fund.

- Put the rest of the money into a money market deposit account or other insured fund.

Bonds pay considerably lower returns than stocks over time, but they are typically safer. Investors traditionally have purchased bonds to keep a portion of their money in a safe haven in case stock prices fall, because bonds often increase in value when stocks fall.

The federal government insures bank deposits and money market deposit accounts, usually up to $250,000 in losses. (Money market mutual funds — containing instruments like government bonds, Treasury bills and certificates of deposit — are not federally insured.) For a full rundown of which accounts are government-insured, and which are not, check this Federal Deposit Insurance Corp. link.

Step 5: Consider your investment time horizon

Here’s one more thing to take into account: The proportion of money you put in stocks should depend also on how soon you’ll need to use your money. That’s why the rules of thumb above take your age into account. You can tolerate more risk if you know you have 20 years to make up any losses. If you’re planning to retire and will need your money within five years, you’re better off limiting your risk.

What is your approach to retirement savings? Share with us in comments below or on our Facebook page.

Kari Huus contributed to this post.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.