Let’s be clear: Here at Money Talks News, we believe that saving money is almost always a good thing.

Almost always.

There are times when pinching pennies actually can backfire, robbing you of cash instead of helping you keep more coins in your purse.

Following are some key ways to “save” money that often prove costly.

1. Saving money upfront, paying on the back end

Ah, the bargain-priced printer! It appeared to be such a good deal when you got it for less than $50. But the first time you needed to buy a replacement ink cartridge, you got a bad case of sticker shock.

As David Connett, former editor of The Recycler, told Business Insider:

“They sell the printers cheap. They sell the consumables at a very expensive price. And basically it’s a formula: The cheaper the printer, the more expensive the consumables.”

The hidden cost of these bargain printers is a reminder that sometimes it makes more sense to pay more now in order to shell out less over time.

2. Purchasing a house to ‘save’ on rent

Buying a house can be smart. That is especially true if you plan to stay in the house over the long run. In general, the longer you remain in the house, the better a deal it is.

But a house can also quickly become a money pit. Closing costs, insurance, repairs, taxes — the list goes on and on.

When researchers at three U.S. universities crunched the numbers, they concluded that if you want to build wealth, renting is the way to go.

Study co-author Ken Johnson, a real estate economist at Florida Atlantic University, summarized their findings:

“On average, renting and reinvesting wins in terms of wealth creation regardless of property appreciation, because property appreciation is highly correlated with gains in the traditional financial asset classes of stocks and bonds.”

Homebuying might be even less attractive today, as a result of the 2017 Tax Cuts and Jobs Act. Tax deductions such as mortgage interest are now out of reach for more homeowners, as we detailed in 2019 in the article “5 Tax Deductions You Almost Surely Won’t Claim This Year.”

3. Using a 401(k) loan to ‘save’ on interest costs

Some workplaces allow employees to tap their 401(k) account early to pay for expenses such as education costs, a down payment on a home or unreimbursed medical costs.

The employee takes the money out as a loan and pays interest back to himself or herself instead of paying the money to a traditional lender.

Sounds like a great deal. But it’s not.

As we explain in “5 Common and Costly Retirement Investing Mistakes,” raiding your retirement account early can deprive you of months or years of compounding interest gains. That can make a huge difference in the size of your nest egg.

Instead of dipping into your 401(k), build an emergency fund and turn to it in times of need.

4. Always shopping at warehouse clubs

A warehouse club membership can be a great way to cut costs, particularly for large households. However, there are costs that some people forget to factor into their savings — like the annual membership fee.

Many warehouse clubs also do not accept coupons. It’s possible if not likely that combining coupons with a little strategic shopping at your local grocery store will net you a better price than at the warehouse club.

So, don’t rule out shopping at warehouse clubs. But if you buy everything there, you probably are wasting some money. For more, check out “19 Purchases You Should Avoid at Warehouse Clubs.”

5. Buying in bulk

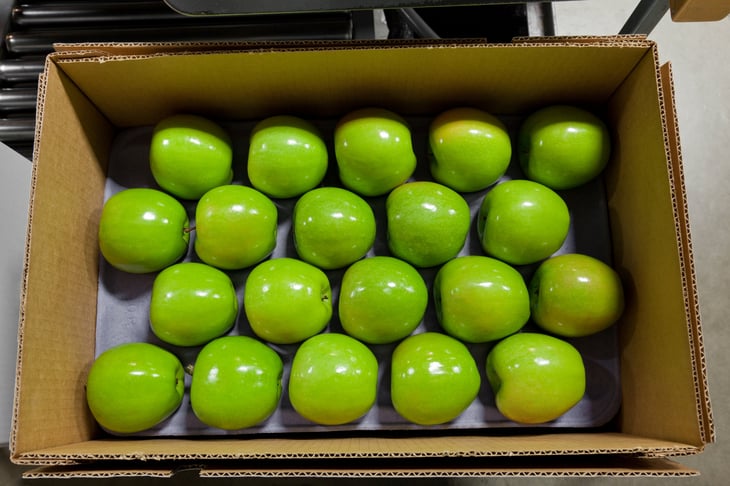

Buying in bulk — whether at a warehouse club or elsewhere — can be a great deal. But if you’re not careful, it can waste money, too.

Purchasing a bag of five cantaloupes for a song makes no sense if three-quarters of your purchase rots before you eat it. This is among the sins we cite in “10 Mistakes That Cost You Money at Warehouse Stores.”

A great bulk deal also can tempt you to buy something you don’t really need. Are you really going to finish that mammoth plastic jug of pretzels? Or are you going to tire of eating the same snack day after day and end up tossing half of it?

6. Skipping doctor and dentist appointments

Yes, health care has gotten outrageously expensive. Even if you have health insurance, chances are good that you have a high deductible that makes you think twice about seeing the doctor. Dental care isn’t much cheaper.

So, you might be tempted to put off doctor and dentist appointments in hopes of saving a little cash. But that can be a huge mistake.

Filling a cavity is relatively inexpensive. But if you skip regular checkups and a cavity gets so bad that it requires a crown — or worse, a root canal — costs can soar quickly.

If you are experiencing symptoms, make an appointment to see your physician while the illness is easier — and less expensive — to treat.

7. Driving across town for a good deal

If you have to drive 10 miles out of your way to fill up at the cheapest gas station, it’s no bargain. A clothing sale at a retailer downtown quickly loses its luster if you have to pay for parking.

Sometimes, you have to do some serious number crunching before deciding whether a deal is a steal — or a waste of your time and money.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.