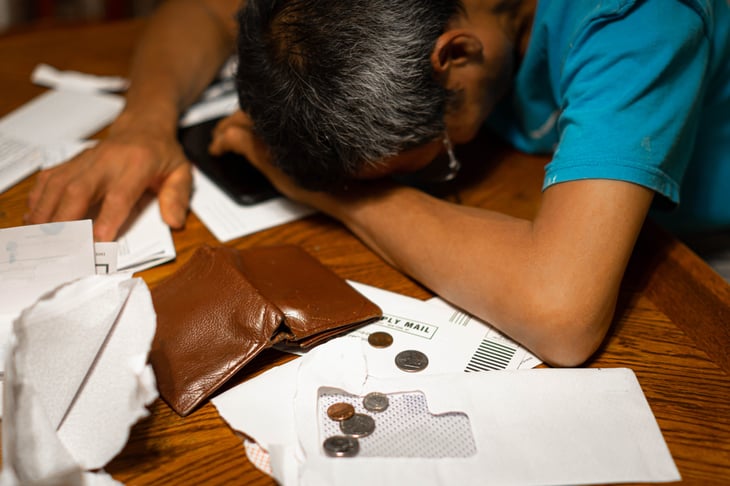

With inflation roaring like a hurricane into our lives, many of us have begun to seek shelter by making big shifts in how we handle our money.

Recently, financial services company Charles Schwab surveyed 1,000 participants in 401(k) plans across the nation and asked how inflation is changing their money behaviors.

A full 79% said inflation was impacting their spending, saving and investing in some way. The answers of those surveyed indicate that today’s inflation could have a negative and long-lasting toll on the finances of millions of people.

Following are the survey respondents’ answers as to how inflation is impacting their wallets.

8. Reduced my 401(k) contributions

Respondents who said inflation is affecting their financial habits in this way: 15%

Even in the most difficult times, it is important to keep saving for your golden years.

Any time you stop contributing to a retirement plan, you rob yourself of both the initial savings and future gains you could make on that money.

But some are finding that inflation has left them no other option than to cut back on their 401(k) contributions.

7. Investing less outside of a 401(k) plan

Respondents who said inflation is affecting their financial habits in this way: 18%

Even those who are lucky enough to continue making contributions to a 401(k) plan might find that they don’t have the extra cash to make other types of investments.

Historically, investing when the stock market is down — as it is now — has paid large dividends in the future. But it’s impossible to find the money to invest when you are simply hoping to pay your bills each month.

6. Saving less in an emergency fund

Respondents who said inflation is affecting their financial habits in this way: 20%

You never know when an emergency — from a leaky roof to an expensive medical procedure — will strike. So it’s important to have money put aside for such unpleasant surprises, as we have noted in stories such as “6 Reasons Retirees Still Need an Emergency Fund.”

However, when inflation pushes you to the edge of your budget and beyond, an emergency fund takes a back seat to mere financial survival.

5. Paying off less debt

Respondents who said inflation is affecting their financial habits in this way: 21%

Perhaps the best way to improve your financial future is to get rid of expensive debts. If you have been carrying debt at 15% interest and decide to pay it off, you are essentially getting a 15% return while plugging a major hole in your leaky finances.

Unfortunately, today’s high inflation means the goal of eliminating debt might have to wait for better times. Once you are ready to tackle your debts again, check out “Tips and Tricks to Help You Destroy Debt.”

4. Spending more in general

Respondents who said inflation is affecting their financial habits in this way: 30%

Not being able to pay off debts is bad, but the situation becomes infinitely worse when you also end up spending more — and possibly adding to your debts.

If you can, now is the time to concentrate on ways to cut back wherever possible. For more, read “21 Items to Cut From Your Budget That You Won’t Even Miss.”

3. Buying cheaper products

Respondents who said inflation is affecting their financial habits in this way: 32%

When the money gets tight, smart savers get creative. If you cannot afford the rising price of groceries and other goods, it might be time to explore alternatives, such as shopping more often at the dollar store.

For tips on what to buy once you get there, check out “21 of the Best Things to Buy at the Dollar Store.”

2. Saving less in general

Respondents who said inflation is affecting their financial habits in this way: 33%

One-third of us have simply decided that in the face of higher prices, we cannot save as much as we used to. That’s just the heartbreaking reality.

Or is it? Even in the face of today’s skyrocketing prices, you can still find ways to put away a little cash. Learn how in “9 of the Best Ways to Save Money on a Tight Budget.”

1. Making fewer purchases

Respondents who said inflation is affecting their financial habits in this way: 34%

Of all the items on this list, this might be the one that offers a silver lining in the thundercloud that is inflation.

On the one hand, it’s a bit sad that today’s higher prices are preventing us from buying some of the things we want. But let’s face it: Almost all of us would be better off if we exercised a little more self-restraint when it comes to our spending.

Having to say “no” to our spending desires today is painful but perhaps it will create a good habit that will benefit us when times get better down the road.

Getting your finances in tip-top shape

If inflation has got you down, it’s time to rise up and take control of your financial life.

You can start to turn the tide by enrolling in the Money Talks News course Money Made Simple.

MTN founder Stacy Johnson offers 14 weeks of lessons on money basics in this course. You will learn how to improve your financial life in all the following areas:

- Budgeting

- Banking

- Credit

- Taxes

- Insurance

- Investing

- Real estate

- Estate planning

After finishing these lessons, you will be ready to manage money more efficiently while spending less time getting the results you want. As Stacy writes:

“Whatever your situation, understanding and learning to control your money is going to improve your life. If you’re rich, you want to stay that way. If you’re not, you want to get that way.”

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.