There’s no time stamp on when recessions pop up, or how long they last. Our last recession was two months long at the onset of the COVID-19 pandemic in 2020, making it the shortest on record.

The one before that was the Great Recession starting in 2007 and lasting 18 months, the longest downturn since World War II.

If the stock market and economy are keeping you on the edge of your seat, you can look for signs of a recession before it hits. That can help you determine whether you should start preparing for a recession, and the act of getting your finances ready for a possible downturn should give you some peace of mind.

An inexact science

Before we dive into the possible warning signs of a recession, it’s worth noting that predicting a recession is not an exact science.

So, while the following warning signs historically have served as indicators that a recession might be on the horizon, that doesn’t mean they are foolproof. The economy is dynamic, and there is no list of indicators that have preceded every past recession.

Still, the following indicators tend to be a good place to start looking if you’re worried about whether a recession lies ahead.

Sign No. 1: The yield curve inverts

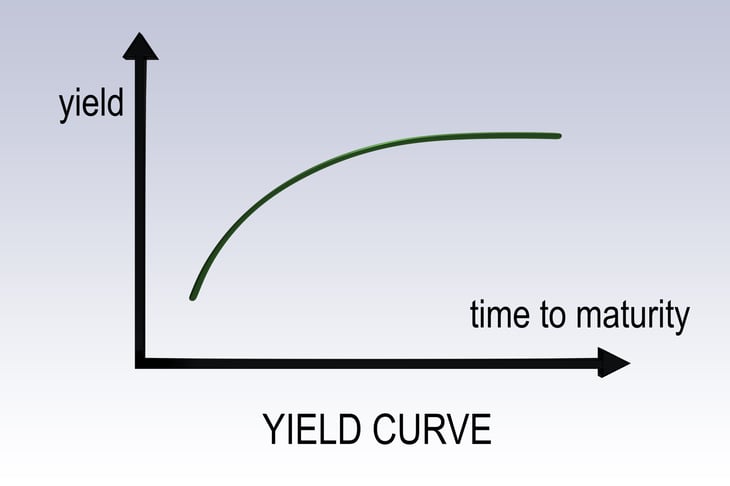

Typically, long-term bonds pay more than short-term bonds, as illustrated above. This makes sense: If you agree to tie up your money for longer periods, you should be paid more for your trouble. This is why a five-year certificate of deposit (CD) pays more than a one-year CD.

Rarely, however, the reverse is true: Long-term bonds start paying less than short-term bonds. When that happens, a recession often follows. In fact, this situation, known as an inverted or negative yield curve, has proven a highly accurate recession predictor.

Why would long-term bonds ever pay less than short-term bonds? The nation’s central bank, the Federal Reserve — or “the Fed” for short — controls short-term rates, but the market controls the rates on longer-term securities.

The Fed can raise short-term rates, which is exactly what they started doing in March 2022, for the first time since 2018. But if investors start thinking things don’t look so good in the economy, they keep their powder dry by buying long-term bonds. The more they buy and bid up the price, the lower the rates on these securities go.

The yield curve did dip into negative territory in late March 2022. It quickly recovered, but it’s worth noting that it was the first time the yield curve turned negative since 2019 and, before that, 2006.

What to watch: You can find Treasury yields on the U.S. Treasury Department’s website. CNBC also tracks in real time the spread, or difference, between the yields on two-year and 10-year Treasurys.

Sign No. 2: The Leading Economic Index slips

The Conference Board’s Leading Economic Index (LEI) is one predictor of global economic health. The Conference Board, a nonprofit research group, describes the index as one of “the key elements in an early warning system to signal peaks and troughs in the global business cycle,” with the LEI specifically anticipating turning points in the business cycle.

Monthly dips in the Leading Economic Index aren’t alarming. However, year-over-year drops in the benchmark have been followed by recessions in the past.

The LEI increased by 0.3% from February to March, and by 1.9% over the six months leading up to March, so there’s no reason for concern based on this indicator right now.

What to watch: Keep an eye on Conference Board press releases or media coverage of the index.

Sign No. 3: Interest rates rise

Government monetary policy can be another economic bellwether. We’ll explain what to watch, but first, a quick refresher on how it works.

The Federal Reserve influences the economy by using a couple of tools. One of those tools is control over short-term interest rates via the target federal funds rate. If the economy is in the doldrums, it can lower the federal funds rate to encourage consumers and businesses to borrow, buy and invest, which stimulates the economy. That’s why this rate was kept near zero for years following the Great Recession that began in December 2007.

On the other hand, if the economy is growing too fast, that can lead to rising prices, otherwise known as inflation. To cool things down, the Fed raises the federal funds rate, which serves to put the brakes on the economy by discouraging both consumers and businesses from borrowing and spending as much.

While interest rates don’t directly affect the stock market, if businesses have to pay more in interest, that hurts their profits, which will ultimately be reflected in a lower stock price.

Also, as rates rise, investors often sell stocks, driving prices lower. Why do they sell? Think about it: If you can earn high interest from insured bank accounts or guaranteed Treasury bonds, why take a chance on stocks?

Again, the Fed resumed raising the federal funds rate in March 2022, marking the first rate hike since 2018. The hike in May — a half-point — was the largest increase since 2000.

What to watch: The Federal Reserve’s Federal Open Market Committee posts statements, which include any votes to change the federal funds rate, after each of its regularly scheduled meetings. The meetings are also widely covered by the financial media.

Sign No. 4: Consumer sentiment falls

Another economic indicator published by the Conference Board, the Consumer Confidence Survey, monitors everything from Americans’ buying intentions and vacation plans to their expectations for inflation, stock prices and interest rates.

After an uptick in March, consumer confidence fell slightly in April. The Consumer Confidence Index was at 107.3 for the month, down from 107.6. During the recession at the beginning of the COVID-19 pandemic, the index was less than 90.

Fluctuation is normal, especially as economic conditions shift. The pandemic, the rising costs of products and the war in Ukraine can change how people feel about the economy from month to month. But if consumer confidence continues to drop, that could be a sign of a looming recession.

What to watch: The Consumer Confidence Survey is updated monthly. Track press releases for it on the Conference Board’s website. The survey is also widely covered in the media.

Sign No. 5: Business confidence cools

Like consumer confidence, business confidence can shed light on the direction of the economy.

The Conference Board’s Measure of CEO Confidence remained in positive territory — 57 — in the first quarter of 2022. (The board considers measures of more than 50 points as positive, and lower readings as negative.) But this measure marked the third consecutive quarter of decline.

CEOs’ assessment of the current general economic conditions, and their expectations for the near future, also declined.

The outlook of small-business owners isn’t any rosier, according to the National Federation of Independent Business’ Small Business Optimism Index.

In March, inflation overtook labor quality as the top problem among small businesses. In fact, the share of owners raising their average selling prices reached its highest level in the survey’s 48-year history.

Moreover, the share of owners who expect better business conditions over the next six months fell to its lowest level in the survey’s history.

What to watch: Business confidence gauges like the Measure of CEO Confidence and CFO Survey are updated quarterly. The Small Business Optimism Index is updated monthly.

Sign No. 6: Vanguard’s risk forecast worsens

Vanguard is one of the biggest asset management firms in the world, so its economic outlooks can help paint a picture of how to monitor fluctuation in the economy.

Before the recession that started in late 2007, Vanguard’s six-month forecast had said the probability of a recession in six months was greater than 40%, according to The New York Times.

The firm’s forecast for 2022 — subtitled “Striking a better balance” — was overall optimistic, if cautiously so:

“While the economic recovery is expected to continue through 2022, the easy gains in growth from rebounding activity are behind us. We expect growth in both the U.S. and the euro area to slow down to 4% in 2022.”

In March, however, Vanguard downgraded its 2022 estimated growth for the U.S. from 4% to 3.5% — which is where it remained going into May.

What to watch: Vanguard posts its monthly market perspectives on its “Our Insights” webpage and issues press releases about its annual outlooks.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.