Editor's Note: This story originally appeared on SmartAsset.com.

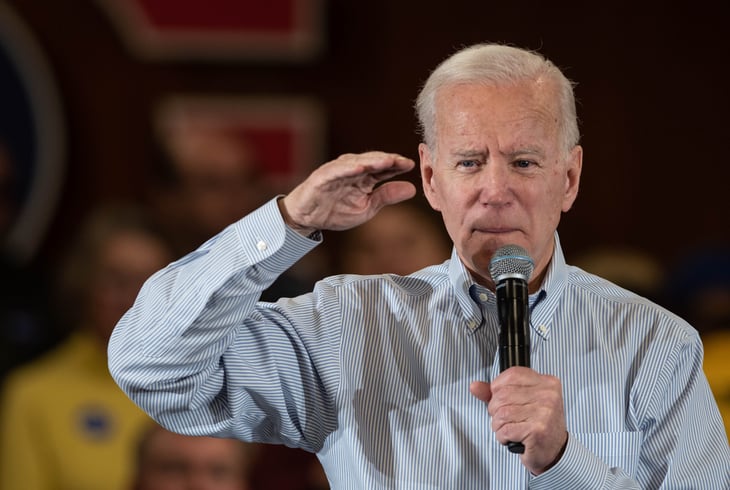

The framework for the $1.85 trillion Build Back Better Act includes thousands of dollars in tax credits and federal assistance for millions of Americans. Let’s break down how much you could get and save from President Joe Biden’s infrastructure plan.

The $1.85 trillion spending bill supports bipartisan initiatives to rebuild physical infrastructure nationwide and pushes beyond to embrace Biden’s health, education and climate change goals.

The White House says the legislation’s framework will help the U.S. meet climate goals, create millions of good-paying jobs and grow the economy “from the bottom up and the middle out.”

Here are several ways that the Build Back Better legislation could put money in your pocket and help you save.

1. Clean energy tax credits

The new infrastructure bill calls on Congress to invest $555 billion in clean energy and climate investments. This program would cut the cost of solar panel installations on your home’s rooftop by 30% and shorten the payback period by roughly five years.

The Center for Sustainable Energy says that the average solar panel system installation could cost from $15,000 to $25,000 — so you could save between $4,500 and $7,500.

The spending bill also includes an electric vehicle tax credit that could save an average middle-class family $12,500 when they buy an American-made electric vehicle.

2. Child care and preschool investments

Biden’s spending plan invests $400 billion in free preschool for more than 6 million 3- and 4-year-old children and expand affordable child care for 90% of families with young children nationwide.

Free preschool could save parents $8,600 annually, which is how much the White House estimates preschool costs every year. This program would also save two parents with an annual income of $100,000 and one toddler more than $5,000 in child care savings annually.

The White House says that every $1 invested in child care and early education could yield between $3 and $7 long-term — research shows that children who benefit from these programs could perform better in school, have higher high school and college graduation rates and earn more money in their careers.

3. Child tax and earned income tax credits

The Build Back Better framework includes $200 billion for child tax and earned income tax credits.

The expanded Child Tax Credit would be extended for 2022 and pay qualifying families $300 monthly for each child under age 6 and $250 for each child between ages 6 and 17.

The Earned Income Tax Credit would also get extended to 2022 and pay up to $6,728, depending on tax filing status, annual income and number of children.

Use SmartAsset’s free child tax credit calculator to figure out how much you could get.

4. Home care investments

The spending bill would invest $150 billion to deliver affordable home care to older Americans and those with disabilities. Qualifying families could save hundreds of dollars — the White House estimates that families pay roughly $5,800 out of pocket annually for just four hours of home care per week.

5. Housing investments

The Democrats’ legislation calls on Congress to invest $150 billion in building, rehabilitating and improving over 1 million affordable homes. This program would include a first-generation down-payment fund that offers qualifying homebuyers a maximum of $20,000 or 10% of the purchase price.

6. Health insurance credits

The spending bill framework includes $130 billion to reduce health insurance premiums for 9 million Americans.

This program would extend and expand the Premium Tax Credit, which allows individuals and families to get a refund for premiums on health insurance coverage they buy on the Affordable Care Act Marketplace. The White House says this will save an average of $600 per person annually.

7. Higher education investments

The Build Back Better legislation will invest $40 billion in higher education and workforce programs. The framework would increase the maximum Pell Grant by $550 for over 5 million students “enrolled in public and private, non-profit colleges and expand access to DREAMers.”

8. Medicare investments

The spending bill framework invests $35 billion to expand Medicare and help older Americans get access to affordable hearing aids and hearing exams. This could save you hundreds of dollars annually — in 2019 Consumer Reports said survey participants spent an average of $2,588 out-of pocket (over $5,000 for a pair).

It’s worth noting that the spending bill also includes other programs that could put more money in your pocket and help you save.

As an example, the legislation calls on Congress to invest $90 billion in different equity programs, such as maternal health and child nutrition. One of these programs expands free meals during the school year and offers qualifying families $65 monthly per child to buy food in the summer.

Bottom Line

The $1.85 trillion spending bill expands legislation to include health, education and climate change proposals from Biden’s Build Back Better agenda.

These programs would offer millions of Americans thousands of dollars in tax credits and federal assistance. This legislation still needs approval from both chambers of Congress before it can get signed into law.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.