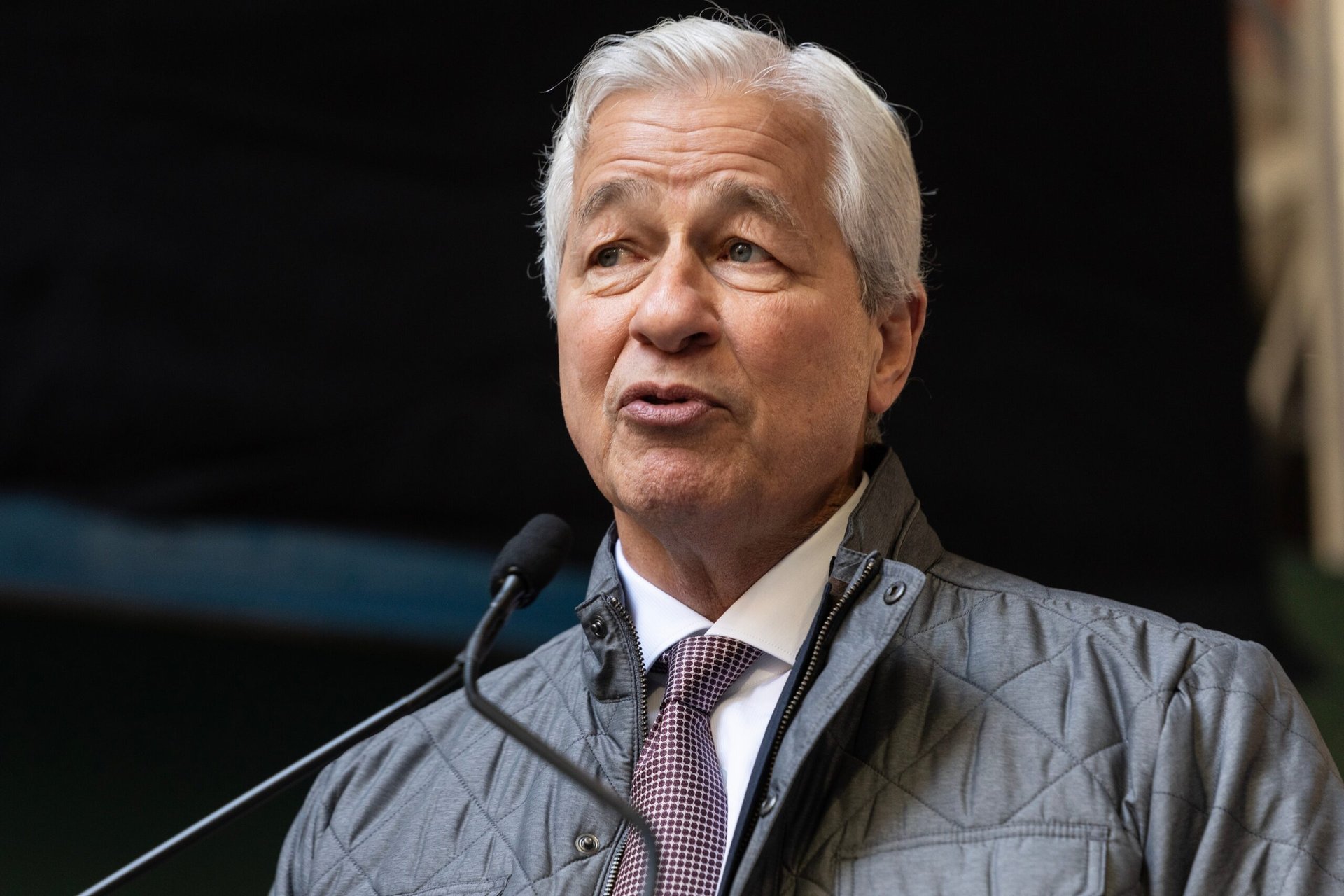

JPMorgan Chase is the biggest bank in the nation, and it has seen record-high profits in recent years. But its CEO, Jamie Dimon, is airing concerns over the country’s financial outlook for 2024 and beyond.

The issues lie at home and overseas, he noted. The war in Ukraine, the latest Israel-Hamas conflict and the Federal Reserve balancing its budget sheet could all have detrimental effects on the U.S. economy for consumers.

“You have all these very powerful forces that are going to be affecting us in ’24 and ’25,” Dimon told CNBC at the annual World Economic Forum meeting in Davos, Switzerland.

However, Dimon notes that the average consumer has remained financially healthy so far thanks to good employment levels and strong savings thanks in part to the government’s pandemic-era stimulus efforts.

The stock market has shown signs of considerable strength as well — including the S&P 500 index rising 24% in 2023 — but Dimon doesn’t believe that’s a sign to relax.

“I think it’s a mistake to assume that everything’s hunky-dory,” he said.

If Dimon is right that hearty savings have kept Americans afloat and that harder economic times might lie ahead, then perhaps it’s time to make sure your savings are buffed up. An emergency fund is an essential asset for surviving a turbulent and unpredictable economy.

On the other hand, if your emergency fund is already flush and you have assets to protect, you certainly don’t want to risk losing them in an economic downturn. Consider putting a meeting with a financial advisor on your to-do list. A service like SmartAsset will match you with vetted, fiduciary financial advisors so you can pick the best one for your personal situation.

No matter how financially well you may feel right now, it’s important to look ahead and be prepared.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.