Editor's Note: This story originally appeared on Upgraded Points.

Young people are an important market for credit card companies, and they can also benefit from access to credit in early adulthood. Having a strong credit score is a fundamental pillar of financial well-being.

Colleges and universities have been willing partners in making these sorts of agreements.

In exchange for providing access to alumni and others affiliated with the college and occasionally licensing university branding, colleges may receive fees and royalties from the credit card issuers with whom they have agreements.

Issuers have targeted colleges and universities in some states more so than others to expand their marketing reach.

Here are the states where credit card companies spend the most marketing to students. See the methodology at the end for details on the ranking.

1. California

- College marketing payments by credit card issuers (2016-2020): $15,513,212

- New credit cards opened via college marketing (2016-2020): 26,973

- Total credit card issuers with college marketing agreements (2016-2020): 6

- Total college institutions with marketing agreements (2016-2020): 15

2. Pennsylvania

- College marketing payments by credit card issuers (2016-2020): $12,186,751

- New credit cards opened via college marketing (2016-2020): 8,872

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 32

3. Kansas

- College marketing payments by credit card issuers (2016-2020): $10,580,884

- New credit cards opened via college marketing (2016-2020): 8,968

- Total credit card issuers with college marketing agreements (2016-2020): 1

- Total college institutions with marketing agreements (2016-2020): 10

4. Texas

- College marketing payments by credit card issuers (2016-2020): $8,649,704

- New credit cards opened via college marketing (2016-2020): 8,302

- Total credit card issuers with college marketing agreements (2016-2020): 6

- Total college institutions with marketing agreements (2016-2020): 18

5. Indiana

- College marketing payments by credit card issuers (2016-2020): $7,926,760

- New credit cards opened via college marketing (2016-2020): 17,586

- Total credit card issuers with college marketing agreements (2016-2020): 5

- Total college institutions with marketing agreements (2016-2020): 10

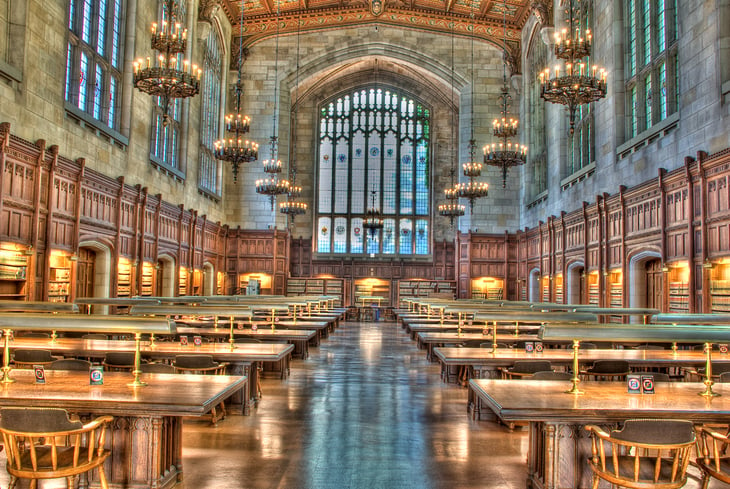

6. Michigan

- College marketing payments by credit card issuers (2016-2020): $7,649,756

- New credit cards opened via college marketing (2016-2020): 4,289

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 9

7. North Carolina

- College marketing payments by credit card issuers (2016-2020): $5,495,096

- New credit cards opened via college marketing (2016-2020): 4,198

- Total credit card issuers with college marketing agreements (2016-2020): 2

- Total college institutions with marketing agreements (2016-2020): 12

8. Georgia

- College marketing payments by credit card issuers (2016-2020): $4,564,899

- New credit cards opened via college marketing (2016-2020): 3,865

- Total credit card issuers with college marketing agreements (2016-2020): 5

- Total college institutions with marketing agreements (2016-2020): 9

9. New York

- College marketing payments by credit card issuers (2016-2020): $4,186,019

- New credit cards opened via college marketing (2016-2020): 11,861

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 13

10. Illinois

- College marketing payments by credit card issuers (2016-2020): $3,571,524

- New credit cards opened via college marketing (2016-2020): 5,722

- Total credit card issuers with college marketing agreements (2016-2020): 7

- Total college institutions with marketing agreements (2016-2020): 9

11. Florida

- College marketing payments by credit card issuers (2016-2020): $3,551,913

- New credit cards opened via college marketing (2016-2020): 12,308

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 13

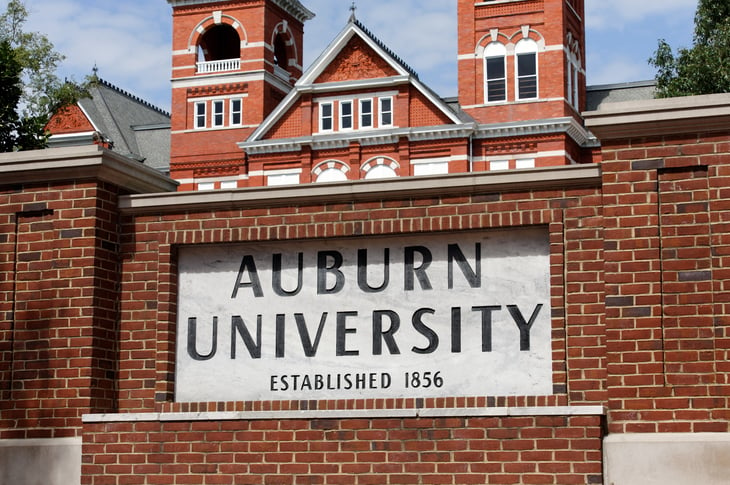

12. Alabama

- College marketing payments by credit card issuers (2016-2020): $3,317,913

- New credit cards opened via college marketing (2016-2020): 5,865

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 9

13. Iowa

- College marketing payments by credit card issuers (2016-2020): $3,025,860

- New credit cards opened via college marketing (2016-2020): 2,289

- Total credit card issuers with college marketing agreements (2016-2020): 3

- Total college institutions with marketing agreements (2016-2020): 6

14. Massachusetts

- College marketing payments by credit card issuers (2016-2020): $2,902,430

- New credit cards opened via college marketing (2016-2020): 9,341

- Total credit card issuers with college marketing agreements (2016-2020): 4

- Total college institutions with marketing agreements (2016-2020): 10

15. Connecticut

- College marketing payments by credit card issuers (2016-2020): $2,338,799

- New credit cards opened via college marketing (2016-2020): 1,313

- Total credit card issuers with college marketing agreements (2016-2020): 3

- Total college institutions with marketing agreements (2016-2020): 4

Methodology

To determine the locations where credit card companies spend the most marketing to students, researchers at Upgraded Points analyzed data from the Consumer Financial Protection Bureau’s Credit CARD Act data.

The researchers ranked states according to the total marketing payments made to college organizations by credit card issuers from 2016 to 2020. In the event of a tie, the state with the greater total new credit cards opened from college marketing agreements from 2016 to 2020 was ranked higher.

Universities, alumni associations, and other university-affiliated institutions and foundations were considered college organizations for the purposes of this analysis.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.