Falling for deceptive marketing can be like accidentally walking into a spider’s web. Just as a spider creates a beautiful web to capture its prey, marketers design campaigns to influence consumers’ decisions.

The nonprofit group Consumers’ Checkbook has been publishing consumer advice and research for more than 40 years and recently compiled a list of some of the most manipulative marketing tactics. Understanding those tactics and learning how to avoid their influence is key to saving money and avoiding buyer’s remorse.

You can break free from the entangling web of deceptive marketing by being a mindful shopper. Mindful shopping involves setting a clear plan and budget ahead of time, researching and comparing brands, considering the true value of what you’re buying, and more. Utilizing those skills can help you combat the tricky marketing practices that follow.

Price tricks

Several of the marketing tactics on Consumers’ Checkbook’s list rely on pricing psychology, such as using fake sale prices or “charm prices.”

For a recent analysis, Consumers’ Checkbook’s tracked sale prices at 24 retailers for 33 weeks and found that fake discounts are becoming more prevalent, with 21 of those retailers using this pricing trick during that period. Amazon, Banana Republic, Dick’s Sporting Goods, Foot Locker, Gap, Nordstrom, Old Navy, Wayfair and Williams Sonoma were the worst offenders. They used fake discounts so often that it gave the appearance of constant sales.

“Fake discounts” refers to price reductions that aren’t genuine or are otherwise misleading, such as if a product’s original price was raised before the “discount” was calculated. Stores use them to create urgency amongst consumers in hopes of pushing them to buy something they may have otherwise ignored. So research the regular prices of products you’re interested in. This will give you a baseline for comparison, helping you confirm the authenticity of any discounts.

There are also “charm prices,” which are prices characterized by numbers just below round figures, like $9.99 instead of $10. It’s a psychological trick to make consumers think they’re getting a better deal since the number before the decimal point — which consumers tend to focus on — is lower. Try to focus on the true value of the product instead of getting swayed by the “left-digit effect.”

Mouse traps

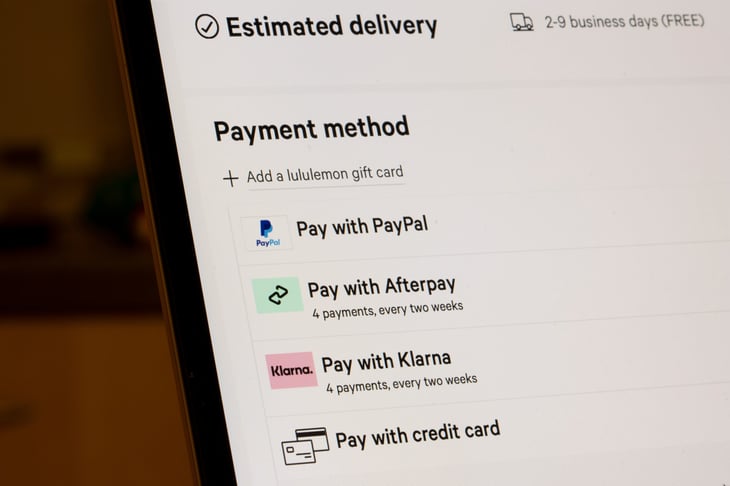

Another type of manipulative marketing practice is what we’ll call a mouse trap. Examples include bait-and-switch maneuvers and buy now, pay later (BNPL) programs.

While bait-and-switch tactics are nothing new, BNPL programs are a relatively new tactic that has soared in popularity recently. And as they’ve gotten more popular, delinquency rates amongst these programs’ users have gone up.

BNPL programs are like layaway: Consumers pay for their items in installments. The Consumer Financial Protection Bureau, a federal agency, notes that these offers may seem risk-free, but that’s not the case. These loans don’t have consistent consumer protections. Offering a BNPL option at checkout can encourage consumers to take on debt while possibly falling prey to fees they didn’t realize they’d be paying.

Avoiding debt is always best, of course, but if you’re going to make use of BNPL, be extra careful to read the terms and conditions first and ensure your payments are on time.

Value tricks

Another type of influential marketing tactic involves creating the appearance of a greater value. Examples include free gifts, loyalty programs and bulk buys.

Companies may offer free items alongside purchases to make the overall deal seem more attractive — even if the freebie doesn’t actually have much value. It can create a sense of urgency and excitement. For example, a business may offer you a free gift if you spend an additional $10. That may be enticing, but you could be spending more money than you intended, or you could be spending the extra $10 for a “free” item that would have cost a couple of bucks independently.

Always assess the actual value of what you’d be getting for free, as if you were purchasing the freebie alone.

Many companies also offer loyalty programs, rewarding repeat customers with points, discounts and exclusive offers. This sounds great for consumers and sometimes truly is. But these programs are designed to push consumers to spend more than they would otherwise in pursuit of points, so be mindful of that.

When buying in bulk, always compute the cost per unit so you can make sure it’s cheaper than if you bought the item not in bulk. Not everything sold in bulk is cheaper per unit.

Spy tricks

Cookies. They aren’t just a sweet snack. They’re also a tracking software that collects information about your online browsing behavior. The collected data can include which pages you visited, your time spent on a site, and what you clicked on or searched for while on the page.

Data brokers compile this information and use it to create a profile of you. And unfortunately, that type of data or profile gets sold off. If you’ve seen online ads that seem to know your tastes too well, cookies are the likely culprit.

The Public Interest Research Group notes one unsavory example of such practices: Some consumers who searched for phrases like “need money help” on Google have been shown ads for predatory loans that have interest rates of more than 1,700%.

Mind games

Marketing isn’t just picking an image that appeals to consumers or coming up with taglines. It can involve psychology, as marketers are trying to convince you to buy products even if you had no desire for it in the first place.

One such method they resort to is flattery. This includes ads that use language like “exclusive offer just for you” or “specially selected for you,” which makes consumers feel special. Always question how personal these ads may really be and whether you truly need the product they’re trying to sell you. Flattery also tries to create a sense of loyalty, so don’t be afraid to push back and look at similar products from other retailers.

Another example of a marketing mind game is accepting alternative payment methods.

Some companies have taken note of casinos’ use of chips instead of traditional money, turning to alternative methods of payment. For example, paying via your Starbucks mobile app rather than pulling out your credit card for every transaction can make you feel like you never spent money on that $5 latte.

Sneaky tricks

Some businesses may offer free trials and then automatically start charging your card for the service without your approval. Considering that 51% of respondents in a Bankrate survey said they’ve had a subscription or membership account incur unwanted charges at some point, you may have fallen victim to this sneaky business practice already.

Set up reminders every time you enter a free trial period so you can unsubscribe before the service starts charging you — unless of course, you’d like to keep the subscription.

Dark patterns are another sneaky trick that uses design to manipulate consumers. They often rely on confusing wording to get consumers to purchase or sign up for something without realizing it. Examples can include email sign-ups with counterintuitive “yes” or “no” buttons, such as a “no” button that is green rather than red.

The Federal Trade Commission sued Amazon in 2023, alleging that the company tricked users into unknowingly signing up for Prime memberships on the checkout screen through misleading wording and then made it hard to cancel their subscriptions.

Pay close attention to wording around a site, especially during the checkout process. Be sure to also monitor your bank account for any unapproved or unusual charges.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.