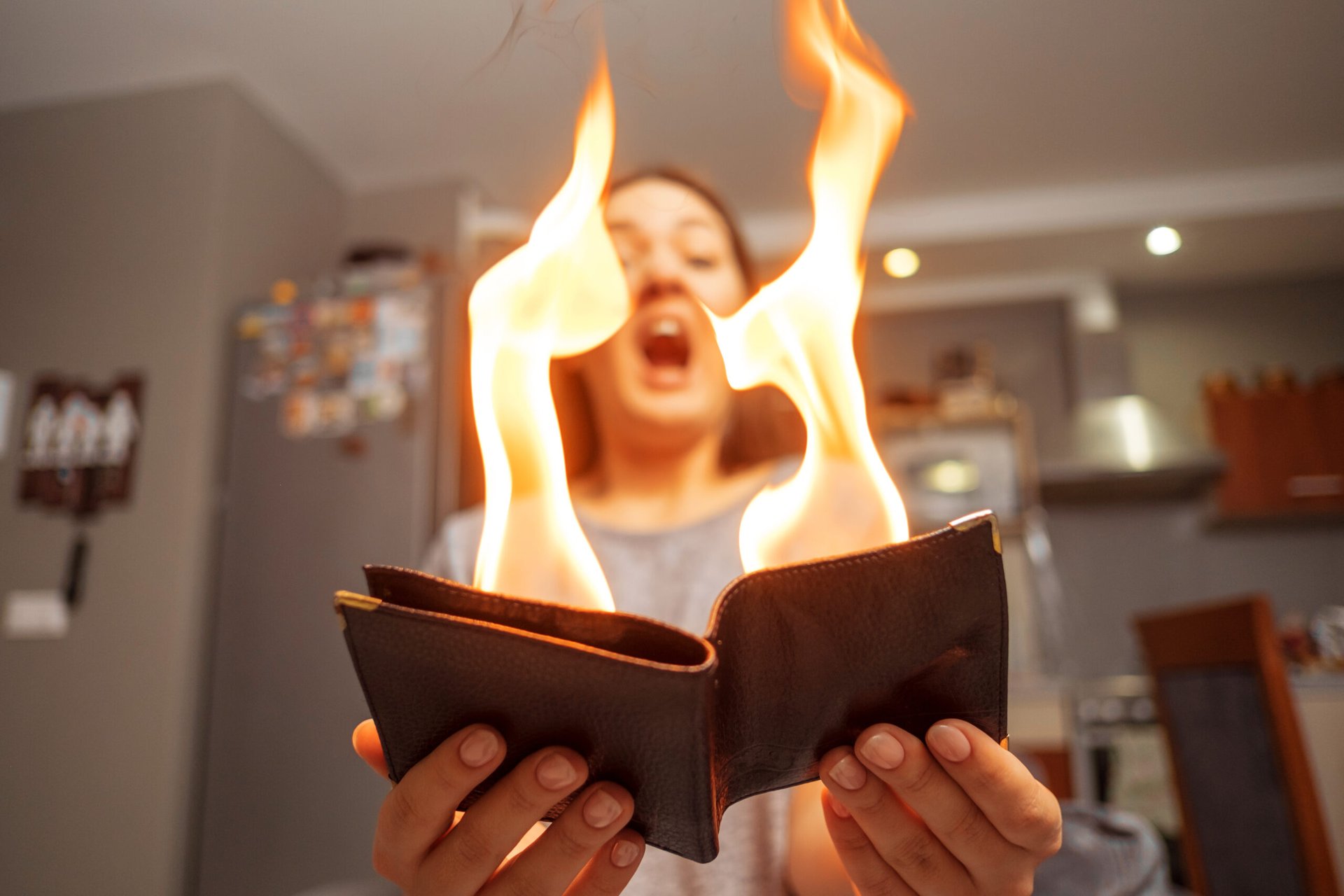

Feeling like your paycheck doesn’t go as far lately? That’s not your imagination. That’s inflation.

According to the Consumer Price Index, overall inflation jumped 6.8% between November 2020 and November 2021. That’s the biggest leap in nearly 40 years.

Sound scary? It is. But don’t let financial fears paralyze you. Instead, look for ways to turn inflationary woes into financial wins.

Understand: We’re not talking just about short-term inflation-proofing. Tactics such as using coupons or wearing your winter coat an extra year are fine ways to balance the household budget. But you also need to think long-term.

Yes, using grocery coupons will save you $10 this week. But the purchasing power of that $10 is being eroded every year. So why not put it into an investing platform, rather than into your piggy bank?

Or why not use the hour(s) you spent researching and downloading those coupons to find a much bigger gain, such as saving hundreds of dollars every year on an essential expense?

A few savvy tactics can save you some serious coin. Take a look.

1. Add $1.7 million to your retirement

Think you’re doing okay with your company’s entry-level 401(k) offering or with picking your own investment opportunities? Think again.

According to a Vanguard study, on average, a hypothetical self-managed $500,000 investment will grow into $1.69 million in 25 years. Not bad. But check this out: Under the care of an adviser, according to the Vanguard study, that same money would turn into $3.4 million. Don’t you want twice as much from the same investment?

Imagine what you could do with an extra $1.7 million. You could put it toward retirement, a dream vacation, home remodels, helping out the kids … the possibilities are endless.

Fortunately, finding the perfect pro has never been easier. With a free matching service called SmartAsset, you’ll be connected with up to three local financial advisers. Each adviser is a fiduciary and can make sure you’re getting the most from your investments.

Of course, there’s no guarantee that a professional will perform better than you, but with so much at stake, it would be foolish not to at least check it out. The process takes only a few minutes, and in most cases, you’ll get a free retirement consultation immediately.

Isn’t it time you made more on your investments? Find your adviser match now.

(Please carefully review the methodologies employed in the Vanguard white paper, “Putting a Value on your Value: Quantifying Vanguard Advisor’s Alpha.”)

2. Save $700+ every year on car insurance

That’s a pretty nice chunk of change, huh? And it’s not just a one-time thing: People who switch auto insurance to Progressive save that much every … single … year!

The money you save (every year!) can go toward gasoline, repairs or an “eventual new car” savings account. Or you could make it work for you somewhere else: a retirement plan, an emergency fund, invested in a nonretirement account to inflation-proof those savings.

Progressive is known for its robust insurance protection, so saving on premiums doesn’t mean skimping on coverage. Did we mention that you’ll save on premiums every year? And if you have two (or more) cars in your household, well, ka-ching!

In just a couple of minutes, you can have the protection you need for hundreds of dollars less. Kind of makes you want to cry, doesn’t it, to think of all the dollars you’ve overpaid for years?

Take a couple of minutes to request a free quote from Progressive today, and start keeping more of what’s yours.

3. Build a commercial real estate empire

Remember that $10 you saved on groceries? That’s all it takes to get started investing in real estate with Fundrise.

And that investments could add up to big gains. The average investor was up 26% over three years and more than 50% over five years, according to Fundrise.

Sure, past performance doesn’t guarantee a future one. But real estate is one of the best ways to diversify and avoid the sometimes scary highs and lows of the stock market.

Plus, as a real estate investor, you won’t have to do stuff like interview potential tenants or collect the rent. Fundrise takes care of that. It only takes a few minutes to start investing, and you can start with as little as $10.

See why more than 170,000 investors invest with Fundrise. Sign up now in seconds.

4. Invest in iconic paintings by word-class artists

Billionaires collect art, so why don’t you?

Once upon a time, only the obscenely wealthy could invest in fine art. The rest of us were left reading articles about how a painting that sold for 45 British pounds in 1958 fetched a whopping $450.3 million at auction in 2017.

Who wouldn’t want a piece of that? Now, with a company called Masterworks, you can become part of the global art market.

When buying stock in a big company, you order as many shares as you can afford. It’s like that with Masterworks.

Again, no one can promise that the works you’re a part-owner of will skyrocket in value and never lose ground. Past performance versus future results, and all that. But when fine art appreciates, it can do so in a big, big way. One November 2021 art auction had jumps such as, “original price $1 million, sale price $16.9 million” and “original price $6.7 million, sale price $50.8 million.”

Want to own a piece of art history and diversify your portfolio? Skip the waitlist and get started today

Bonus: Get a free $991.20 every year

More than 1 million Americans have reported saving an average of $991.20 each simply by reading the totally free Money Talks Newsletter.

Our newsletter gives you a daily dose of specific advice to help you make more, spend less and invest like a pro.

It takes less than five seconds to subscribe and, if you don’t like it, less than five seconds to unsubscribe. Sign up for our free newsletter right now and see what you’ve been missing.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.