The single biggest reason you’re paying too much for car insurance: Insurance companies know you hate to think about it, much less to shop around for it. Result? They raise your rates, confident that the hassle of switching means you’ll stay where you are and pay what you’re told.

Not cool. Solution? Regain control by periodically shopping your insurance to make sure you’re getting the best deal.

In the article that follows, you’re going to learn all you need to know about the various components of car insurance. But if all you really want to know is how to find the lowest-cost policy, you can accomplish that right now, no further work necessary.

Comparing insurance companies these days is a snap. Just click on either (or both) of these two comparison tools. Both are unbiased, independent services that compare rates from lots of companies in one place, without requiring a lot of work on your end and minus annoying phone calls.

Neither service costs a dime, and both will shop your existing coverage within minutes.

Want to know more about what’s under the hood of the typical car insurance policy? You’re in the right place. This step-by-step guide is about paying as little as possible for car insurance, while still maintaining enough coverage. Many of the things you’ll learn here will also apply to other insurance policies you’ll encounter, from home and health to life.

I promise not to bore you to death as we go through it. Let’s get started!

Getting organized

If you don’t know how much you’re paying for car insurance, it’s time to find out. Create a spreadsheet so you can see not just the total, but exactly which components you’re paying for within your policy.

Don’t make this a big deal: It’s not. You can do it during commercial breaks while you’re watching TV.

Pull out your car policy and record the pertinent information: what’s covered, deductibles, phone numbers, policy due dates, etc. Then, save this information in the cloud. Having it in one place will give you everything you need to know at a glance and make shopping for better rates a snap.

I use Microsoft Excel for my insurance spreadsheets, but you can use Google Sheets or just about any program that will allow you to write stuff down and keep it straight.

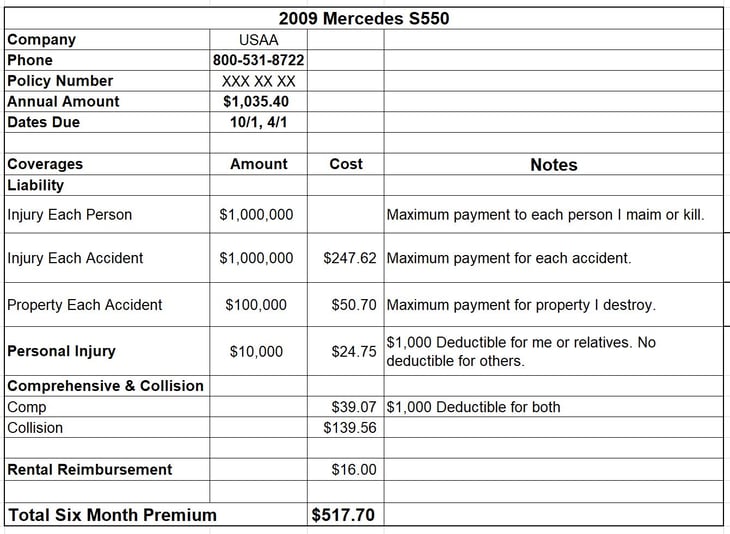

As an example, here’s my spreadsheet for the car I drive. I got this information by logging on to my insurance company’s website, but I could also have gotten it from the paper policy I receive by snail mail every six months when I pay the bill.

Liability

The liability portion of your policy pays for damage you do to other people and their stuff. This is typically required by law and always required by common sense. It’s one area of your car policy where you don’t want to scrimp.

As you can see, I can screw up to the tune of $1 million per person and event, with a $100,000 limit on property. You can also see I made a note to remind myself exactly what this coverage does.

For my personal situation, $1 million in liability is hopefully adequate. But when you think about how much liability to buy, you need to consider your situation and net worth, not mine.

While you don’t want to pay for more coverage than you need, it’s important not to underinsure yourself in this critical area. If you think you may not have enough, do what I did: Call your company, see how much additional liability will cost, plug it into your personal cost/benefit equation and then decide what to do. While liability coverage isn’t cheap, you’ll likely find adding more isn’t all that expensive.

Do you need comprehensive and collision?

Liability pays for other people and their stuff. Comprehensive and collision coverage pay for damage to your car.

If someone else hits you and it’s their fault, their liability insurance should pay to repair or replace your car. If you screw up and your car is damaged, however, that’s where your collision coverage comes in. Comprehensive coverage also pays if your car gets stolen, vandalized or otherwise damaged, such as by hail.

When I wrote about this topic more than 15 years ago for a book called “Money Made Simple,” I didn’t have comprehensive or collision coverage on my car.

Why wasn’t I paying for them? I didn’t feel I needed them. In short, when it came to damage from my own mistakes, my car was self-insured.

At that time, I was driving a car worth only about $3,000. So, worst-case scenario, I would have been out three grand to replace it. That was a risk I was willing to take versus paying hundreds in extra premiums every year.

The rule of thumb when it comes to comp and collision: If the premiums exceed 10% of the value of your car, you might consider dropping the coverage. I considered; I dropped.

Today, the car I drive is worth considerably more than $3,000, so I’m now paying for comp and collision.

If you borrow to buy a car, this isn’t a choice you can make because your lender will force you to have comp and collision. So, here we have an example of less being more. Pay cash for a cheap car, and you’ll have less car to insure, less time spent shopping for coverage, less time spent working to pay for insurance and more time for leisure.

One more note regarding comprehensive and collision coverage: If you self-insure your car and do away with comprehensive and collision, don’t forget this fact when you rent a car. Because if you don’t have comp and collision on your car at home, you won’t have coverage for cars you rent, either.

So, if you’re not given this coverage free as a perk on a credit card, you may have to voluntarily submit to one of the greatest rip-offs of the modern age: paying for insurance, known as a collision damage waiver, at the rental-car counter.

Deductibles

The deductible is the portion of a loss you’re expected to cover. You’ll note mine is fairly high at $1,000. Why so high? Because while losing a grand wouldn’t be a pleasant experience, it wouldn’t send me to McDonald’s for a second job. Remember, I’m covering against catastrophe, not inconvenience.

Many people have a $250 deductible, yet would never think of filing a claim for less than $1,000 because they’d be justifiably afraid of a rate hike. This is nuts. If you’re willing to lose $1,000 if you screw up, then raise your deductible to $1,000 — you’ll save 10% to 20% on your bill because a higher deductible generally means a lower premium.

This is the simplest and fastest way to save on car insurance.

Personal injury protection

The next part of my policy is personal injury protection. This is insurance that covers me and my passengers if we’re hurt in an accident. This coverage is required where I live, but I’m only buying $10,000 worth.

Sound crazy? Well, keep in mind that no matter how I’m injured — by plane, train or automobile — I’ve got medical insurance that will pay for my physical reassembly. I don’t carry passengers often, but those I do carry also tend to have health insurance. If the accident is my fault, my passengers will be covered by my liability and/or their health insurance.

If the accident isn’t my fault, all of us will be covered by the other driver’s liability insurance and/or our health insurance. If the other driver doesn’t have insurance, I could have uninsured motorist coverage to pay the medical bills for all of us. So, personal injury coverage wouldn’t appear to do me a lot of good, which is why I don’t have much of it.

Uninsured motorist

As the name implies, uninsured motorist coverage pays for the damage caused by people illegally careening around without liability insurance.

Uninsured motorist coverage is not required in my state, but I have it anyway.

Shopping for a policy

So, we’ve gone over my insurance bill. While I’m sure you found it riveting, much of it will be meaningless to you unless you drive a car like mine, have the same driving record I have and live where I live. What was the point of explaining it to you? So you’d see how I manage my car insurance and learn something about how to manage your own insurance.

Perhaps you think I knew all this stuff because I’m a personal finance writer. Nope. I know this stuff because I called the toll-free number on my insurance policy and sat on the phone with some hapless customer service representative until I understood what I was paying for.

Once I understood my policy — including how much I’d pay to increase coverages and how much I’d save by reducing them — I was in the position of being able to decide how to customize my policy to meet my personal needs. For example, maybe I should drop rental-car coverage, since I’ve been driving for 40 years and have never used it. Maybe I should raise my liability coverage as my net worth increases.

In addition to being able to make my coverage match my needs, having the facts at hand also allows me to shop this policy easily and virtually instantly. All I have to do is add a few columns to my spreadsheet to accommodate quotes from other companies.

The best way to get competing quotes is to shop online. You can either go to websites that compare quotes from various companies or go directly to individual company sites. You’ll obviously have to input some info, but now that you have your spreadsheet, it won’t be too challenging.

Better still, there are now free services like Gabi and The Zebra that will do the work for you and produce a report showing what rates various insurers would give you.

The last time I did this, inputting the required information to get competing quotes took exactly 10 minutes and 42 seconds. Coincidentally, that’s the approximate amount of time spent in commercial breaks during your typical half-hour sitcom.

As for how often you should shop for your policy, here’s what I do: I shop for home and car one year, health and life the next. I generally do it during the holidays, when I have a bit more leisure time and sometimes need an excuse to get away from family for a while.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.