Suze Orman has the status of a financial guru. But I have never been able to understand why this self-proclaimed expert has such a following.

Imagine a celebrity chef who has given herself food poisoning, or a car expert who couldn’t change a tire.

Orman has said things about money over the years that make me think she’s more sizzle than steak. The following are prime examples.

1. The impressive car she couldn’t afford

First, let me tell you the reason I finally wrote this article after considering it for years. In a 2017 CNBC story, Orman said:

“There was a time that I was in a relationship with a very, very wealthy person and I wanted to impress this person and I didn’t have money yet, so I went out and I leased a car. I leased a 750iL BMW, and my lease payments were like eight hundred dollars a month.”

There are people who will foolishly trap themselves into inescapable, multiyear contracts they can’t afford to impress themselves or others. Maybe you’ve met one. But someone who calls herself a personal finance expert?

I’ve made money mistakes, and said as much in articles and podcast episodes like “My 10 Dumbest Money Moves.” But leasing an $800-a-month car I couldn’t afford because I was dating someone “very, very wealthy”? Nope. Not when I was 18, 21, 41 or ever.

If this were the only odd thing that had escaped Orman’s lips, perhaps I could let it go and continue believing she’s a personal finance whiz. Unfortunately, that’s not the case.

2. The restaurant that wasn’t

According to Orman’s website, after attending college for a degree in social work, she worked as a waitress in a Berkeley, California, bakery. After seven years of waiting tables, she borrowed $50,000 from several customers so she could start a restaurant of her own.

But here’s where it gets weird. Instead of using the loan to open a restaurant, she deposited it with brokerage firm Merrill Lynch, where she proceeded to lose all of it through speculative trading, blaming the losses on a crooked financial adviser. That’s when she decided to become an investment adviser herself and got a job at the very firm that had just ripped her off.

Orman goes on to say that, while working there, she sued Merrill Lynch, recovered the money and repaid her would-be investors.

Still, the fact remains she borrowed money and, rather than using it as promised, effectively lost it all gambling instead. Ever done anything like that? Me neither.

I get it: We all love the story of someone who learns from mistakes and becomes successful. But there has to be a limit. If I voluntarily chopped off my own foot, you might grudgingly applaud my participation in a marathon. But wouldn’t you always question my judgment?

3. Flip-flop on stocks

In 2007, The New York Times Magazine interviewed Orman. After indicating her net worth was north of $30 million and her preferred investment was municipal bonds, here’s what she said when asked whether she “played” the stock market:

“I have a million dollars in the stock market, because if I lose a million dollars, I don’t personally care.”

A personal finance expert who doesn’t believe in stocks? Since stocks are one of the few investments capable of beating inflation, that’s strange — and bad — advice. Not only does she essentially compare stocks with gambling by suggesting she could lose it all, she also remarkably says she doesn’t mind losing a million dollars.

Orman later apparently changed her mind about stocks, at least for us little people. Just one year later, in an interview with Money Magazine, she decreed that broad-based index funds — suggested by nearly every money expert, including me — should take a back seat to much riskier sector funds. Her words:

“All the stats say that index funds outperform 80% of managed funds out there. And a few years ago I’d have said just buy Vanguard’s S&P 500 index fund (VFINX) or its Total Stock Market index fund (VTSMX). But today I think you have to be more active, and I like exchange-traded funds that let you own particular sectors, like iShares MSCI Emerging Markets (EEM), United States Oil Fund (USO) or the Metals & Mining SPDR (XME).”

A side bet with a sector fund isn’t necessarily dumb. In 2016, when oil was trading at less than $30 a barrel, I suggested investing in an oil ETF. But that’s a side bet. I didn’t suggest selling a diversified index fund to do it. I’d never suggest sector funds over a far more diversified S&P 500 fund for a simple reason: They’re way too risky.

As testimony to the risk of sector investing, here’s how Orman’s recommendations have worked out:

- EEM closed at about $47 per share when she offered her advice on June 19, 2008. On Aug. 9, 2021, it closed at about $52.

- XME closed at about $93 back then. On Aug. 9, it closed at $43.50.

- USO had an adjusted price of about $107 back then. On Aug. 9, it closed at about $47.

So, of her three suggestions, one is up about 11% and two are losers — catastrophically.

And how has the S&P index fund she rejected performed? It cost about $124 per share on June 19, 2008. As of Aug. 9, 2021, it was worth about $410 — an increase of around 230%.

Granted, this was more than a decade ago. Perhaps Orman reversed course sometime between then and now. But even if the funds she recommended had been winners, her advice was still laughable.

For simple advice, check out “The 10 Golden Rules of Becoming a Millionaire.”

4. Prenups for all

As far back as 2005, Orman was pounding the table on prenuptial agreements. She said repeatedly in print and on air that a prenup is essential for all couples, no matter the circumstances.

She also suggested they’re a wonderful bonding experience. From an article on Oprah.com:

“Drawing up a prenuptial agreement together is a sign of incredible trust and financial openness — you’re fooling yourself if you think you can achieve complete intimacy without it.”

Hopefully, she’s not trying to say that you can’t achieve intimacy without a prenup.

What she presumably means is that if you’re going to share your life with someone, it’s important to share your financial life as well. I agree — who wouldn’t? But sharing financial intimacies with your partner isn’t the same as sharing them with your partner, your lawyer and your partner’s lawyer, and then paying thousands of dollars to have them converted into a legally binding document.

Sure, in a world where prenups are free and easy, maybe we should all have one. But in this world, prenups can cost several thousands of dollars or more.

Despite the cost, prenups are essential in certain situations, which I spell out in “Should Everyone Have a Prenup?” But it’s ridiculous to insist that spending that kind of money is mandatory for every couple.

Even more ridiculous is suggesting the process is going to be a “sign of incredible trust and financial openness.” That’s like saying your divorce papers are “a wonderful opportunity for financial openness and an ideal place to reflect on the assets the two of you built together.”

Prenups are by definition the opposite of “incredible trust.”

Having gone through both a prenup and a divorce, trust me: Both may be necessary, but neither is a moonlit walk on the beach.

5. The prepaid debit card

In 2012, Orman started her own prepaid debit card. It lasted a couple of years, then was taken off the market.

To most personal finance pros, prepaid cards are controversial, primarily because of the fees they charge. Thus, the idea of a personal finance expert following in the footsteps of celebrity prepaid card creators could seem questionable.

One of several folks questioning Orman’s card was personal finance writer Philip Taylor, a certified public accountant and someone I personally know. From his review:

“Russell Simmons has a card. It’s bad. The Kardashians created a ‘kard’ in this market. It was bad too. So bad, that it was run out of town. Who’s up for another celebrity-branded prepaid card? This time it’s not just a celebrity. It’s the self-proclaimed ‘Most Trusted Personal Finance Expert’ in America today, Suze Orman. She just released The Approved Card. I like Suze, but I don’t like that she has created this card and is marketing it in this way.”

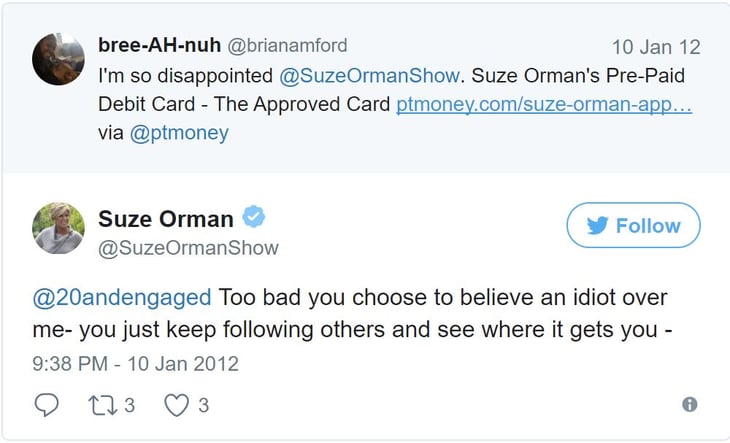

Here’s how Orman responded when someone tweeted a link to Phil’s article:

The blogosphere exploded, with articles from NerdWallet to Free From Broke condemning her tirade.

While Orman may have disagreed with Phil’s arguments, they were perfectly legitimate. He’s no idiot. And threatening a fan by saying “just keep following others and see where it gets you” simply sounds unhinged.

Orman later apologized.

6. Driving Miss Crazy

Orman, like nearly every other personal finance adviser, isn’t a fan of buying cars new. From her Facebook page:

“Remember, the minute a new car is driven off the lot, it loses 20% of its value; if you buy a new used car, you won’t be paying for that.”

Good, sound advice. But if you don’t think people should buy new cars, should you endorse them on TV, as she did in an Acura commercial?

One might argue that appearing in an ad for cars doesn’t compromise Orman’s objectivity or integrity. But the optics are bad: She’s willing to trade her credibility for cash.

I don’t know what it’s like to have a $30 million net worth, nor do I know the temptation of being approached for a national car ad. But I’d like to think that if I already had more money than I could spend, I’d turn down an ad that sent the wrong message to my audience.

But wait, there’s more!

If you think I’m being tough on Orman, you ain’t seen nothin’ yet.

Here’s a one-hour documentary from someone who helped her get where she is. It may be too long for you to watch right now, but if you’re even thinking of giving this woman a dime, or know someone who is, it’s a must-see.

It’s not just Suze

Orman has presumably helped many Americans feel more in control of their money, and I agree with many of the things I’ve heard her say over the years. But this article isn’t just about Orman. It’s about you and where you can find advice you can trust.

It’s reasonable to assume that when you see someone on TV, or see their books on bestseller lists, you can trust their advice. Reasonable, but wrong. Being famous doesn’t make you smart. Oprah Winfrey claiming you’re an expert doesn’t make you one. Being rich doesn’t equate to being wise. Admitting to stupid mistakes doesn’t make them less stupid.

Here’s the bottom line: Read as much as you can from as many sources as you choose. But if you’re going to put your trust somewhere, put it first in those who have academic credentials, a long track record and a history of saying and doing things that are logical and successful.

About me

I founded Money Talks News in 1991. I’m a CPA, and I’ve also earned licenses in stocks, commodities, options principal, mutual funds, life insurance, securities supervisor and real estate.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.