If the recent rash of data breaches has left you worried about having your identity stolen, we have a rare bit of good news: Credit freezes may soon be free nationwide.

A bill that’s working its way through the U.S. Senate calls for credit-reporting companies — like the now-infamous Equifax, as well as Experian and TransUnion — to place and remove credit freezes for free when customers request them to do so.

The legislation — called the Economic Growth, Regulatory Relief and Consumer Protection Act — is poised to be passed by the Senate this week, according to the Wall Street Journal.

As recently as Tuesday, however, senators were still hashing out amendments.

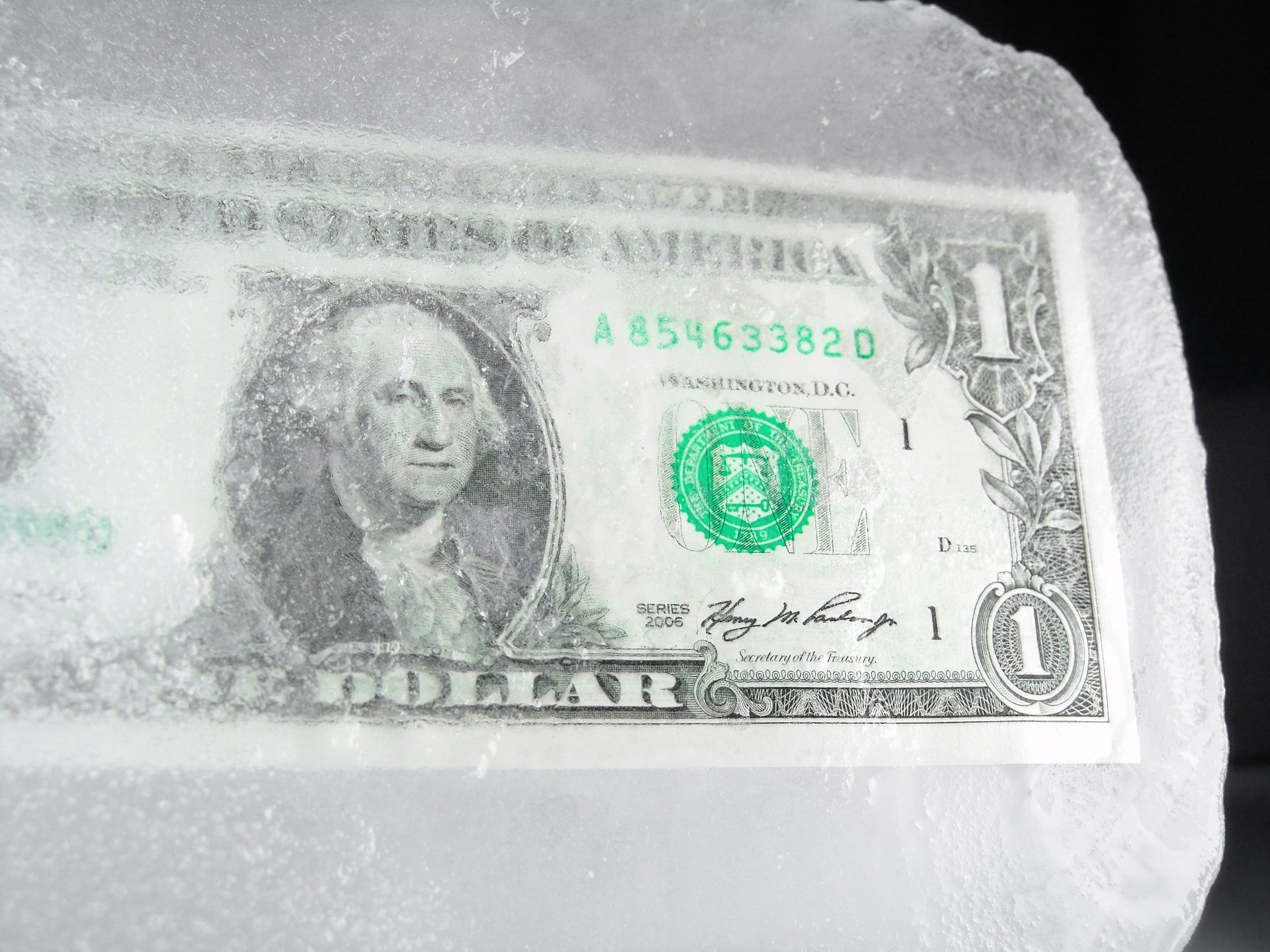

Credit freezes

A credit freeze, also known as a security freeze, blocks others from accessing your credit file.

The U.S. Consumer Finance Protection Bureau explains:

“Creditors typically won’t offer you credit if they can’t access your credit reporting file, so a freeze prevents you or others from opening accounts in your name. Security freezes can be useful in preventing an identity thief from opening a new credit account in your name.”

Credit freezes are generally considered the best way to protect your credit. Currently, though, consumers in many states must pay a fee to place a freeze on their credit file.

Equifax is offering free freezes but only through June 30. And, depending on the state in which you live, the other two major nationwide credit reporting companies — Experian and TransUnion — can charge for freezes.

The legislation

At this point, perhaps you’re considering contacting your congressional representatives to voice your opinion on whether credit freezes should be free.

Just understand that the Economic Growth, Regulatory Relief and Consumer Protection Act focuses on more than credit freeze fees. The language that would make credit freezes free is just one element of the bill.

For example, as the legislation’s name suggests, it contains regulatory rollbacks for the financial industry.

Here’s how the U.S. Congressional Budget Office summarized the bill in an analysis released earlier this month:

“S. 2155 would modify provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) and other laws governing regulation of the financial industry. … The bill also would make changes to consumer mortgage and credit-reporting regulations and to the authorities of the agencies that regulate the financial industry.”

More recently, Bloomberg described the bill as a “sweeping rewrite of financial rules.”

Further, one amendment to the bill could end up benefiting the three major consumer reporting companies, Bloomberg noted last week.

The amendment calls for government-sponsored lenders Fannie Mae and Freddie Mac “to use credit assessments offered by multiple companies, instead of exclusively relying on FICO scores provided by Fair Isaac Corp.” Fair Isaac’s main competitor is VantageScore Solutions — which is owned by Equifax, Experian and TransUnion.

What’s your take on this news? Sound off below or over on our Facebook page.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.