Do you ever look at your cellphone bill and wonder, “Why am I even paying for all this extra stuff?”

Maybe you pay for unlimited data and you only use a few gigabytes of data every month. Or maybe you pay extra for a streaming subscription you never use.

Here are a few tips to clean out your cellphone bill and make sure you don’t pay for things you don’t need.

Review your cellphone plan

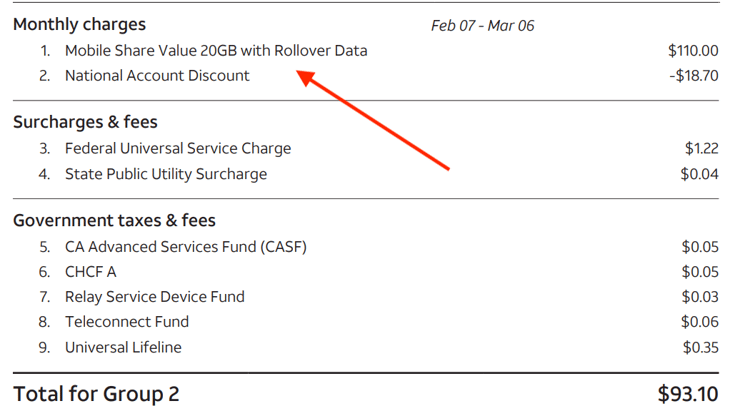

You should always start by checking what cellphone plan you currently pay for. Your cellphone bill should clearly state what plan you use and the associated costs. Here’s an excerpt from my AT&T bill for reference:

You can see that my family and I use the Mobile Share Value 20GB plan, and it costs us $110 a month for that plan. Considering we rarely hit our data cap every month, it feels safe to assume that this limited-data plan works for us.

You should check and see if your data plan makes sense for your data usage. If you feel like you don’t use much data, you could consider reverting to a limited data plan that will cut your bill down.

Likewise, if you’re racking up fees because you go over your monthly data allotment, switching to an unlimited plan will likely save money in the long run.

Check whether you’re still paying off your phone

If your cellphone bill feels too expensive, there’s a good chance it has something to do with your smartphone device. Most wireless providers bundle your phone payment in your cellphone plan bill.

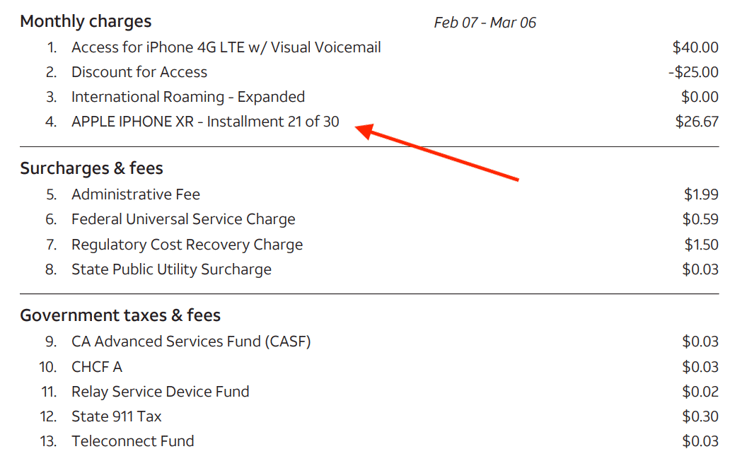

It can be easy to forget that you still have payments left on your phone even a year after you ordered it. Here’s another example from my cellphone bill:

You can see that I’ve still got nine payments left before I officially pay off my iPhone XR. It adds an extra $26.67 to my bill every month, which nearly doubles my total.

It’s possible that your cellphone bill inflates due to your device payment as well. Hopefully, you’re close to paying off your phone completely, and you can cut your cellphone bill even lower.

Make sure you don’t pay for anything extra

Lastly, the third way your cellphone bill can subtly increase is if you’ve got any extra features attached to your cellphone bill.

Make sure to read through your bill and check if you see anything about a streaming service, international data add-on, or any extra hotspot data.

Basically, if anything looks out of the ordinary, there’s a chance an extra feature has been added to your cellphone plan that you don’t want to pay for.

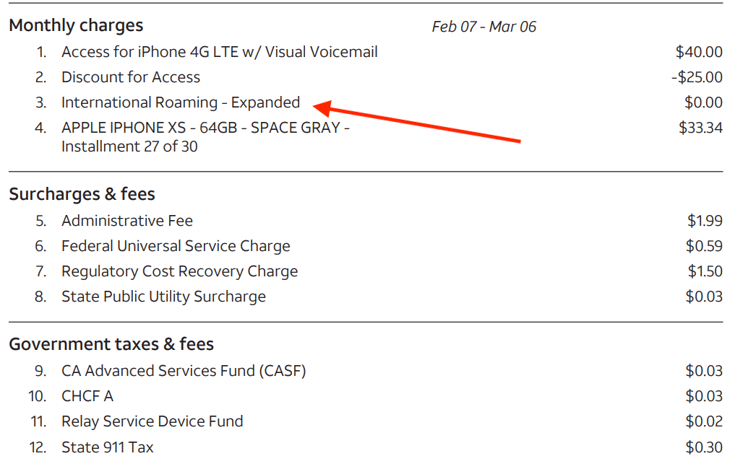

Here’s an example of something I would look for in my bill:

If there were any fees associated with “International Roaming,” I would know something was up with my cellphone bill.

I haven’t left the country, nor has anyone in my family plan, so any charges associated with that would be a big red flag for me to get in touch with a customer service rep and get the charge refunded.

When in doubt, check your cellphone bill, scan through your itemized receipt and make sure nothing looks fishy. Don’t feel afraid to chat with a customer service rep to clarify any charges on your bill.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.