Ready or not, the next season is officially almost here.

The IRS just announced the start date for the season and several other key dates.

Read on for everything you need to know to ensure you don’t miss any deadlines — plus the steep interest rate and penalties you could face if you do miss certain deadlines.

When the tax season starts

The tax season officially starts on Monday, Jan. 29. That means the IRS will begin accepting and processing 2023 returns on that date.

Never file until you have received all your income forms and other tax documents, though, as we explain in “Don’t File Your Taxes Until You Have These 8 Things.”

When IRS Free File opens

The IRS Free File program opens for the 2024 tax season on Friday, Jan. 12.

This program lets taxpayers who made $73,000 or less in 2023 file their taxes electronically for free. Commercial tax filing software companies provide the software used with the service.

When tax returns are due

Tax Day falls on Monday, April 15, for most folks, and Wednesday, April 17, for residents of Maine and Massachusetts due to local holidays. These states will observe Patriots’ Day on April 15 but can push their Tax Day to April 17, as the District of Columbia’s observation of Emancipation Day on April 16 means the IRS will be closed that day.

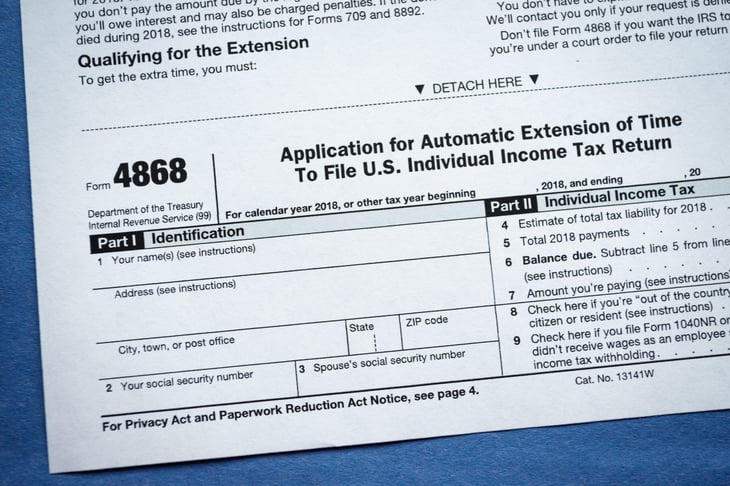

If you want an extension of time to file your return, the deadline to request it also is April 15 for most taxpayers and April 17 for those in Maine and Massachusetts.

Don’t confuse any of these dates with the deadline for filing your state income tax return, though. State deadlines often — but not always — coincide with the federal tax deadline. So, check with your state to be sure.

When tax returns are due for extension filers

If you request an extension, you will have until Tuesday, Oct. 15, to file your return.

Your request will be granted automatically if you file IRS Form 4868 on time.

Just remember that although you can get an extension to file your tax return, you must actually pay any taxes due by the Tax Day deadline. Otherwise, the IRS will charge you interest and might also hit you with a penalty.

The IRS’ interest rate is mighty steep these days. For individuals, it’s 8% as of the first quarter of 2024 — higher than it’s been in years — although it could come down a bit after that.

The penalty for paying your taxes late is usually 0.5% to 1% of the amount you didn’t pay on time, but it can be as high as 25%.

If you also fail to file your return itself by the applicable deadline, the IRS could hit you with another fine. The penalty for filing your return late is usually 5% of the amount of taxes not paid on time, but it, too, can be as high as 25%.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.