You’ve no doubt caught glimpses of Social Security’s worst-case future, likely from politicians or the media: “The retirement trust fund reserve will run dry in 2033!” and “Benefits will be cut by 23%!”

Such projections are arguably alarmist because they assume the federal government will not act to shore up Social Security, which is arguably unlikely. Still, if you’ve ever wondered exactly what the current government estimates could mean for you personally, the Center for a Responsible Federal Budget has some ideas.

The center recently ran numbers from the Social Security Administration and arrived at several projections for what a 23% cut to Social Security benefits in 2033 would mean in terms of dollars lost for retirees of various income level.

Read on for the closest projection for your situation — and to learn what it will take to stave off benefit cuts.

Low-income couples

Projected benefit cuts for low-income couples who would be newly retired in 2033:

- $7,900 per year (in 2023 dollars) for such a couple living off one income

- $10,600 per year (in 2023 dollars) for such a couple living off two incomes

Note that these amounts are not adjusted for inflation. That is to say, they don’t reflect the erosion of a dollar that inevitably will occur between 2023 and 2033. The committee projects that these reductions will be somewhat smaller in 2033 dollars.

Middle-income couples

Projected benefit cuts for middle-income couples who would be newly retired in 2033:

- $13,100 per year (in 2023 dollars) for such a couple living off one income

- $17,400 per year (in 2023 dollars) for such a couple living off two incomes

Again, these amounts are not adjusted for inflation and thus will be somewhat smaller in 2033 dollars.

High-income couples

Projected benefit cuts for high-income couples who would be newly retired in 2033:

- $17,300 per year (in 2023 dollars) for such a couple living off two incomes

- $23,000 per year (in 2023 dollars) for such a couple living off two incomes

Note: The Committee for a Responsible Federal Budget did not specify income thresholds for low-, middle- or high-income couples. So, you’ll have to take your best guess as to which group you fall into.

Single beneficiaries

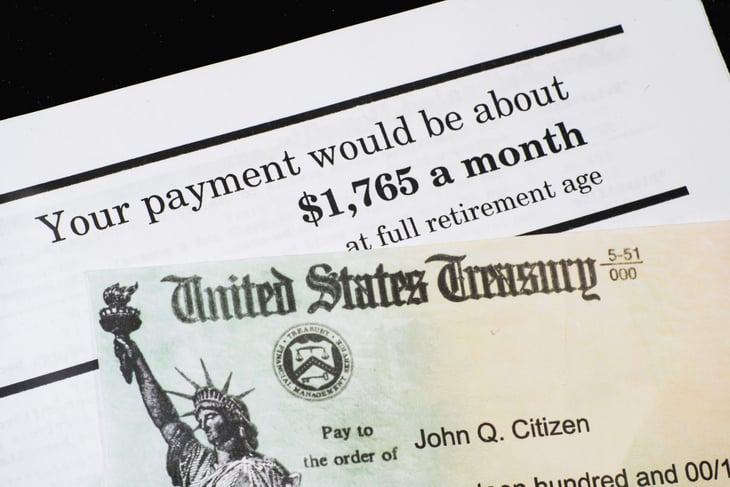

The Committee for a Responsible Federal Budget did not issue projections for single retirees, only for couples. But if you’re a single worker who expects to retire circa 2033 and is wondering how big of a benefit cut to expect, you can ballpark it by checking your latest Social Security statement:

- Get your latest statement via your online Social Security account. (You’ll have to create an account if you don’t have one already, but everyone can benefit from having one, even people yet to retire.)

- Find your expected future monthly benefit amount on the statement.

- Multiply that dollar amount by 0.23 (per the current federal estimate of a 23% cut to everyone’s benefits in 2033). The result will be a very rough, and not inflation-adjusted, estimate of how much your monthly benefit amount will be reduced. Multiply it by 12 if you prefer the yearly equivalent, and shave off a bit if you want to account for inflation.

What you can do about it

The truth is there’s next to nothing you can do to avoid future cuts to Social Security benefits. There’s plenty your representatives and senators can do, though.

Social Security isn’t just a federal program, it’s federal law: The program was created by the Social Security Act of 1935. Making changes to Social Security generally requires new federal legislation. That essentially means only the legislative branch of the federal government — namely Congress — has the power to change Social Security to stave off benefit cuts.

And the sooner Congress acts, the less painful those changes will be. So, you may wish to prod your elected officials in Congress.

Just don’t get your hopes up. As Paul Brandus recently wrote for MarketWatch:

“The clock keeps ticking, and the politicians haven’t done anything. Democrats, Republicans — nothing. They just keep talking around the problem, attacking each other, trying to score political points. … The politicians we keep sending to Congress haven’t done anything because these steps involve inflicting pain on voters, something no politician likes to do.”

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.