An increase of the minimum wage to $15 could help today’s young workers when they finally claim Social Security benefits decades from now, while also increasing revenue for the Social Security program today.

Such workers could see a benefit that is up to about $5,000 higher each year in retirement than they would receive based on today’s federal minimum wage of $7.25 per hour, according to the organization Social Security Works.

That is because each additional dollar a worker earns potentially increases the monthly Social Security benefit amount he or she receives in retirement.

According to Social Security Works:

“If a single worker were to earn the current minimum wage her whole life, and claimed Social Security benefits in 2021 at her full retirement age, she would receive a monthly benefit of just $979.80. In contrast, if she had earned $15 an hour, her monthly benefit would be $1,409.60. That is a Social Security benefit increase of over $5,000 – $5,157.60, to be exact – each and every year for the rest of her life!”

Higher wages also mean more payroll tax revenue for the Social Security system’s coffers, which are facing a shortfall.

Payroll taxes, also known as FICA taxes, are a source of revenue for the system. Employees pay 6.2% of their wages in Social Security payroll taxes, which is matched by their employers. Self-employed workers pay the full 12.4% of their wages in Social Security payroll taxes.

So, when a worker’s wages increase, so does the amount he or she pays in Social Security payroll taxes.

As Social Security Works puts it:

“Contributions from workers’ wages, matched dollar for dollar by their employers, are Social Security’s primary source of revenue. When the minimum wage increases, Social Security’s revenue also increases. … Furthermore, updating the minimum wage increases the average level of wages nationwide, which results in more income for Social Security.”

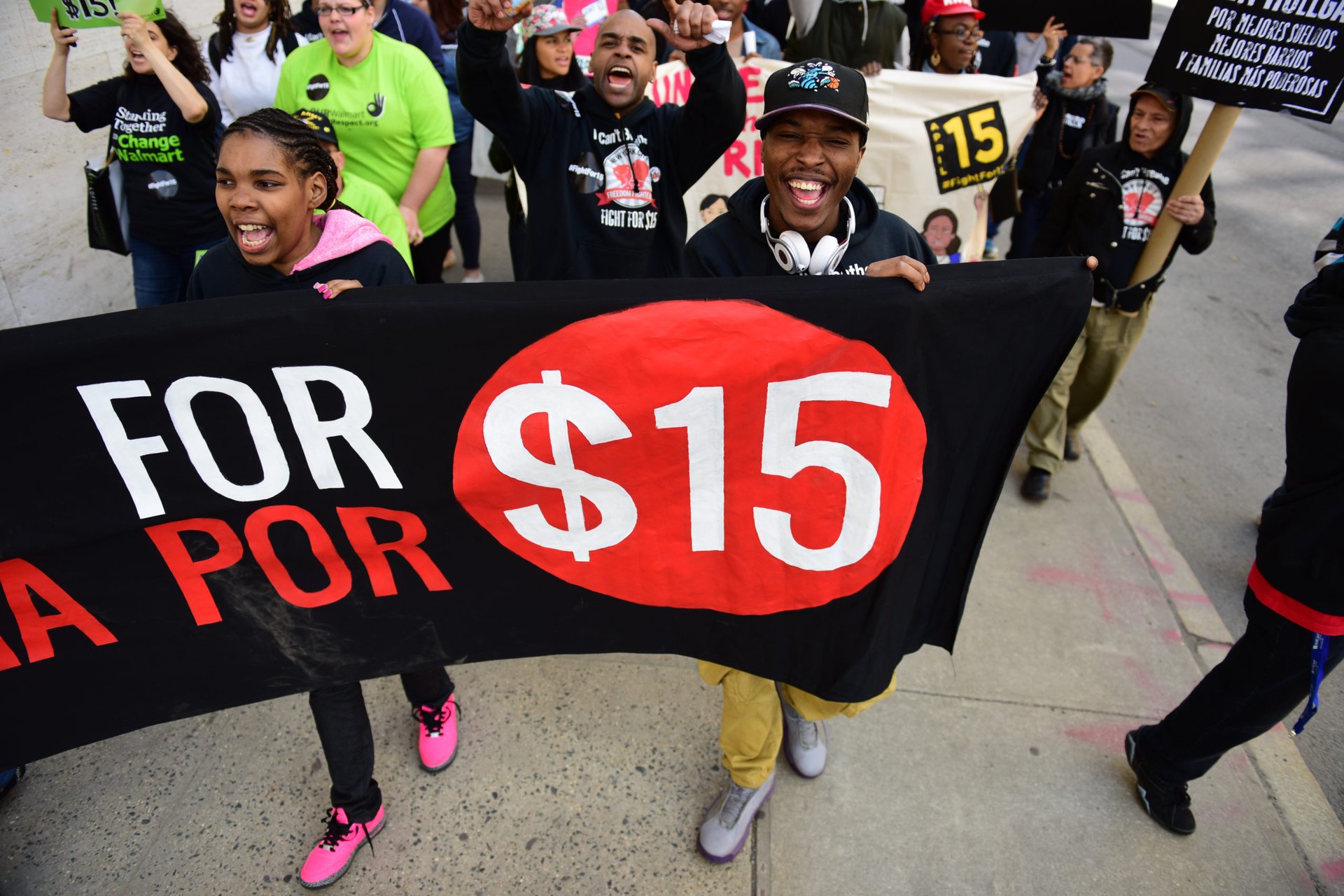

The notion of raising the federally mandated minimum wage has been a hot topic in recent years. Many cities and states have already taken steps to raise the minimum wage in their own communities, including increases that just took effect in January, as we detail in “The Minimum Wage in Every State in 2021.” But a change at the federal level would apply to many more employers across the country.

President Joe Biden and many Democrats say they are in favor of raising the wage to $15. Republicans generally are against such a change.

A minimum wage hike currently is part of Biden’s proposed $1.9 trillion coronavirus relief package, but opposition — both from Republicans and at least a couple of key Democrats — could doom the wage increase, at least for now.

Recently, the nonpartisan Congressional Budget Office looked at the implications of the Raise the Wage Act of 2021 as introduced in the Senate in late January, which also is included in the Democrats’ relief package. This legislation would increase the federal minimum wage in increments, until it reached $15 per hour by June 2025 if passed in March. From there, the minimum wage would continue to increase at the same rate as median hourly wages.

The CBO concluded that such a measure would lift 900,000 people out of poverty by 2025, but would cost the nation 1.4 million jobs over the same time period.

The CBO also says that the Raise the Wage Act would increase the cumulative budget deficit over the 2021-2031 period by $54 billion.

Would you like to earn a higher wage? Take matters into your own hands by negotiating an increase with your employer. For tips on doing so, check out “10 Tips to Remember When Asking for a Raise.“

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.