Here’s a reader question you might have wondered about as well:

Do you have any idea why we are able to get a free credit report once per year, but not the credit score? Why does that cost money, especially since it seems to be part of a credit bureau report and lenders base part of their decision on the score when considering a transaction? – Susan

Before I answer Susan’s question, let’s define the difference between credit reports and credit scores — a lot of people seem to get them confused.

Consider the classes you took in school. All the tests and papers you turned in make up your class history, or report. The A you got at the end of the class that summarized your overall work was your score. Same with credit: Your credit report is the detailed history of your reported credit activities — your credit score boils it all down into a simple number.

Credit Reporting Agencies (CRAs) are required by law to furnish you with a free copy of your credit report every year, but they’re not required to give you a free copy of your credit score.

Credit scores are important. Here’s a video that explains exactly how much damage can be done to your score with some common mistakes.

Why do credit scores exist?

A simple numerical score makes it much easier for the bank’s computer to decide whether to loan you money. It takes time, experience and knowledge to comb through your credit report and decide whether you’re worthy of a loan, but a monkey could read a single digit and shuffle your application off to the proper stack.

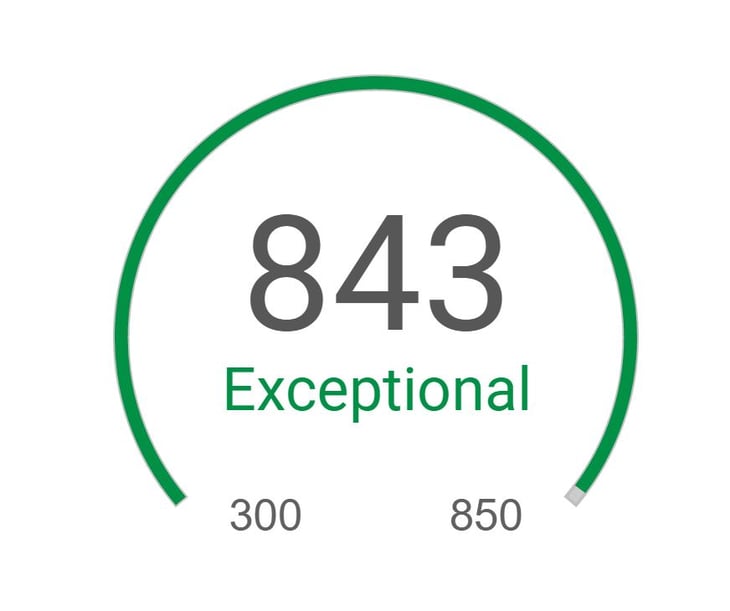

The most popular score — known as a FICO score — rates your credit between 300 and a perfect 850. The higher your score, the better the deal you’re likely to get on loans. Even your insurance rates can be influenced by your credit score: Some insurers believe people who wreck their credit are more likely to wreck their cars.

How to score a free score

When I began writing about credit many years ago, there was virtually no way to see your credit score without paying. Happily, today there are many. Here are a few to try:

- Credit Sesame: There are several sites that offer free credit scores with no strings attached. While they don’t offer the FICO score, the score they do offer is generally close enough. Click here and you’ll have a score in a few seconds. Similar sites include Credit.com, Credit Karma, Quizzle and many more.

Here are some places you can see your actual FICO score free:

- Discover: Free to everyone. No need to be a customer or cardholder to use Discover’s CreditScoreCard website.

- Bank and credit card companies: Other banks, credit unions and credit card companies offer free access to your score, but you have to be a customer or cardholder. Customers can see their scores on an ongoing basis by logging on to a company’s website or by checking their monthly loan or credit-card statements. Companies include:

- USAA: Enroll in free CreditCheck1.

- Merrick Bank: GoScore, a free benefit, includes emailed FICO scores.

- First Bankcard (First National Bank of Omaha)

- Bank of America

- Barclaycard US

- Citi

- Chase Slate card

- American Express

- Wells Fargo: Customers with mortgages, home equity lines of credit, private student loans, personal loans, consumer credit cards and certain auto loans can see their scores through Wells Fargo Mobile banking.

- Pentagon Federal Credit Union

- North Carolina State Employees’ Credit Union

- Digital Federal Credit Union (DCU)

- Pennsylvania State Employees Credit Union (PSECU)

This is a partial list. More financial institutions are offering these services all the time.

- Credit counselors: Did you know that there’s expert financial advice available free 24/7? Where to find it, along with a free look at your credit score, is through credit counseling agencies. Designed to help with debt, these nonprofits will answer questions and help you set up a budget and get your credit score, all free. If you have a debt problem that’s beyond your ability to deal with alone, they also offer low-cost intervention with debt-management plans. We partner with one counseling agency that you can reach in our Solutions Center or by calling 888-739-9616.

You can also find a directory of credit counseling organizations at the National Foundation of Credit Counseling’s website.

Why aren’t credit scores free?

If the reason you clicked on this article was because you wanted a free credit score, you’re done. Click here or visit the sites of one of the companies above.

Perhaps you’ve wondered how some company you’ve never heard of can take your personal credit information, use a secret formula to boil it down into one number, use that number to influence your life in truly radical ways, and then charge you to see it.

I’ve been wondering that for years — so have lots of other consumer advocates.

Here’s a cut-and-paste from a time long ago when I answered a similar question:

While you can get your credit report from annualcreditreport.com, you can’t get your credit score there. In fact, if you want to get the most widely used credit score from the company that created it, Fair Isaac, they’ll charge you $19.95 to see it. And that’s after being forced to wade through a quagmire of up-sells.

Since your credit score is obviously super-important, and is derived from your personal credit history, you may feel justifiably confused by why you should have to pay 20 bucks to see it. The explanation for that I can summarize with one word: lobbying. The financial services lobby in this country is one of the most powerful. To get a fair shake for consumers in virtually anything has always been an uphill battle. In the case of getting a free look at your credit report, for example, it took years. In the case of being able to see your credit score, it hasn’t happened yet.

The financial reform law that Congress passed in 2010 (the Dodd-Frank Wall Street Reform and Consumer Protection Act) came close to fixing this injustice. Annual free credit scores were actually written into one version of the bill, but Republican members of the Senate had this provision removed.

How could they possibly have been persuaded to delete something of obvious benefit to virtually every U.S. citizen? That’s a question for them. My strong suspicion, however, is that the senators in question were more interested in protecting their campaign contributions than their constituents.

In any case, the final version of financial reform legislation only allowed consumers who were denied a loan or suffering some other sort of “adverse action” to get a free look at their credit score. Other “adverse actions” that can result in a free look at your credit score include an increase in your cost of insurance, being charged more for, or being denied, a car lease, or if the interest rate you’re offered on a credit card or loan is higher than one being offered for those with excellent credit.

Got a question you’d like answered?

You can ask a question simply by hitting “reply” to our email newsletter. If you’re not subscribed, fix that right now by clicking here. The questions I’m likeliest to answer are those that will interest other readers. In other words, don’t ask for super-specific advice that applies only to you. And if I don’t get to your question, promise not to hate me. I do my best, but I get a lot more questions than I have time to answer.

About me

I founded Money Talks News in 1991. I’m a CPA, and have also earned licenses in stocks, commodities, options principal, mutual funds, life insurance, securities supervisor and real estate. If you’ve got some time to kill, you can learn more about me here.

Do you look up your credit report periodically? Share with us in comments below or on our Facebook page.

Got more money questions? Browse lots more Ask Stacy answers here.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.