The college years are an exciting time, but they can be an incredibly expensive time, too.

Looking for ways to trim costs and still enjoy all college has to offer?

Here are 15 ways to save money in college.

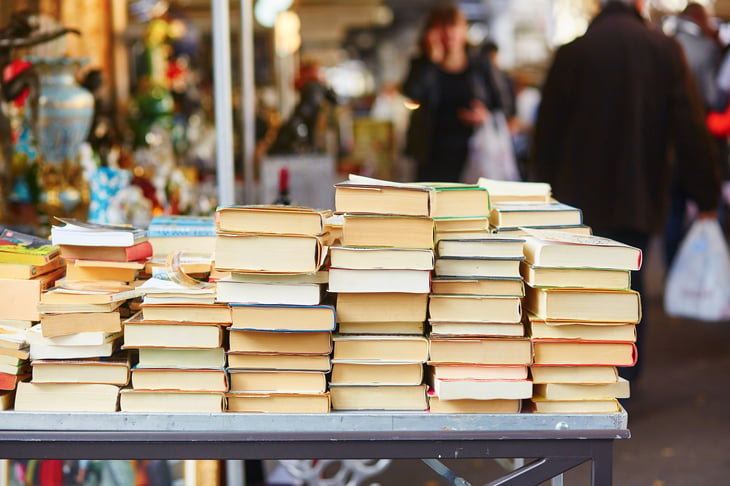

1. Shop online for textbooks

Textbooks are expensive, but there are ways to trim costs by shopping online.

“They can often save money on books by buying used or renting books online,” says Anthony LaBrake, a certified financial planner and associate adviser at Adam Financial Associates in Boca Ration, Florida.

“Chegg.com is a popular website that allows students to buy or sell used books as well as rent textbooks for the semester. Many textbooks also offer electronic editions for a discount to the hard copy, but many students will find they prefer having a physical version of the book.”

Another website to check out is Slugbooks.com.

“Slugbooks.com is a great website for comparing textbook prices across different vendors,” says Courtney Nagle, digital and social media specialist for the National Foundation for Credit Counseling.

For more ideas on this topic, check out: “11 Ways to Save Big on College Textbooks.”

2. Use older versions of textbooks

A nice shiny new book is nice, but when you are trying to save money think used books.

“I would also suggest looking for older versions of textbooks as they are often adequate for the course and can be found cheaper than the newest edition,” LaBrake says. “Professors will oftentimes tell students if an older edition can be used for the class, and some will even offer a separate syllabus with the correct pages for various editions of the course textbook.”

3. Cook your own meals

Lower your food costs by eating in and cooking.

“The most cost-effective way for students to eat is to buy their own groceries and make their own meals,” LaBrake says.

“This can be difficult as a full-time student though, especially if they have no culinary background. It is also usually impossible to do this during freshman year as the living arrangements, such as dorms, often do not include any appliances for cooking. If students do commit to shopping for themselves and cooking their own meals, they can save a significant amount of money on throughout their college career.”

For ideas on ways to cut the cost of groceries, check out this post.

4. Live without a car

This one can be tough. Who doesn’t love the freedom of driving? But this is a cost that many students can avoid.

“If they live on campus or near campus they can find an alternative method of getting around such as a bike, public transportation, or even Uber and Lyft,” says LaBrake. “They will save money that is normally spent on gas and maintenance, as well as avoid paying parking fees that can cost hundreds of dollars at some colleges.”

5. Get credits at a community college

Get some of your credits at a nearby and much less expensive community college.

“To save money on credits, it may make sense to take an extra class at a community college rather than a four-year (college),” says Becky House, education and communications director for American Financial Solutions. “For instance, you need one extra chemistry class. You can add it on to your normal workload or take it over summer at the local college for a lower rate.”

6. Be a resident adviser

Know all there is to know about dorm living? Are you good with people and like to take the lead? Sign up to be a resident adviser, or “RA,” and save on housing costs.

“If you are staying in a dorm, look into being a resident adviser,” House suggests. “You may get discounted rent or other perks.”

7. Live off campus

Living off campus can help to bring down housing costs and other expenses.

“If you have the option of living off campus with roommates, it can save a significant amount of money,” House says. “My stepson is moving into an apartment off campus with his friend. On campus his rent for the dorm (with everything included) was $1,300 a month. Off campus, he will pay $350 a month.”

8. Use your student ID for discounts

Take your student ID with you everywhere you go and ask for discounts.

“Ask about student discounts at establishments near your campus,” Nagle says. “Numerous stores and restaurants offer discounts with a valid student ID, but you usually won’t know until you ask.”

9. Take advantage of free on-campus entertainment

There’s plenty to do on campus for entertainment, and most of it is free to students.

“Save money on entertainment by taking advantage of the free activities offered through your university’s student government,” Nagle suggests. “My campus offers fun events like culinary tours, art classes and tickets to movie premieres at no charge for students. All you have to do is sign up in advance.”

10. Use apps to earn rewards

With the PocketPoints app, you can earn rewards points for keeping your phone locked during college lectures and other classes.

“The app rewards you with points in exchange for keeping your phone locked during class,” Nagle says. “The points can be redeemed for discounts at participating companies. Some of the companies that offer discounts include Target, Domino’s, many clothing brands and local stores near your campus.”

11. Make a budget

Get serious about your cash flow and about saving money by establishing a budget. You want more money coming in than going out in spending each month.

“Make a budget,” House advises. “Not a sexy option, but a necessary tool if you want to save money and make it through college with a minimal amount of debt.”

There a lots of great budgeting apps and online tools. Our favorite is You Need a Budget, YNAB.

This post explains how it works, and covers some of the other budgeting apps.

12. Avoid restaurants and coffee shops

Eating out is expensive. Limit the money you spend on getting coffee or a meal in restaurant or coffee house.

“Limit eating out. If you bought a meal plan at school, use it,” says Joe DePaulo, chief executive officer and co-founder of College Ave Student Loans. “If you are a big coffee drinker, purchase a coffee maker. All of these little expenses — a coffee here, a sandwich there — can really add up.”

13. Get rid of cable

Here’s an expense you don’t need — a pricey cable bill.

“Cable can be a large expense, and with so many inexpensive streaming options, one of the easiest to cut,” DePaulo recommends. “Consider if you or your roommates watch cable enough to justify its costs.”

Consider major streaming services and alternatives.

14. Monitor your cellphone data

Going over the data allowance for the month on your cellphone is going to cost you. Keeping close tabs on your usage will save you money.

“Monitor your phone data,” DePaulo advises. “Going over the allotted data amount on your cellphone plan can wind up being a very costly mistake. Monitor your usage and make sure you stay within your data amount.”

Check out: “The Best Deals on Cellphone Plans for College Students.”

15. Finish your degree in 4 years

Graduating college in four years is critical if you want to keep your cost, and debt, under control.

“One way to save thousands of dollars is to finish your degree in four years,” DePaulo says. “Check in with your department, and make sure you are taking the right classes and courses to finish your degree on time.”

What’s your best advice for college students to conserve on cash? Share with us in comments below or on our Facebook page.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.