The recession waiting game continues. For at least two years, pundits and Americans across the country have been predicting that the nation’s economy will dip into a sustained downtown.

It hasn’t happened. At least, not yet.

That doesn’t mean it won’t, however. Widespread layoffs and some negative economic numbers indicate a recession could still arrive this year or next.

Even if that doesn’t occur relatively soon, one thing is a sure bet: At some point, America will experience a recession again.

And when that happens, the following advice from financial experts might just help you get through the rough times so you can enjoy the better days that will follow.

Stacy Johnson

Money Talks News founder Stacy Johnson, a certified public accountant, has worked in personal finance for 40 years and has many times offered advice on weathering recessions. In the past few years, he has recorded multiple podcasts on the subject:

- “Is a Recession On the Way? Here’s How to Prepare“

- “How to Prepare for the Next Recession or Market Crash“

- “How to Prepare Your Savings for a Recession“

He has also written numerous articles over the years, including “Here’s When the Stock Market Will Stop Falling and It’ll Be Time to Buy” which was published when stocks were falling after the start of the COVID-19 pandemic. Here is something he says in “The 10 Commandments of Wealth and Happiness“:

“Wealth is realized when the economy is booming. But wealth is created when times are tough, unemployment is high, everybody’s freaking out, and there’s nothing but economic misery on the horizon.

Would you rather buy a house for $450,000 or $250,000? Would you rather invest in stocks when the Dow is at 35,000 or 10,000?

Nobody wants their fellow citizens to be out of work. But the cyclical nature of our economy all but ensures this will periodically happen. If you still have a job when the next downturn arrives, it will be the time you’ve been saving for. Don’t listen to all the Chicken Littles in the media. The sky isn’t falling. Put your cash to work and create some wealth.”

Stacy’s point is that bad times are inevitable, but they won’t last forever. Recessions also provide a tremendous opportunity to make investments when prices may be lower. So you should plan for the worst — saving up money in case you end up out of work — and hope for the best: That you’ll be OK and able to use your rainy day money to make it rain.

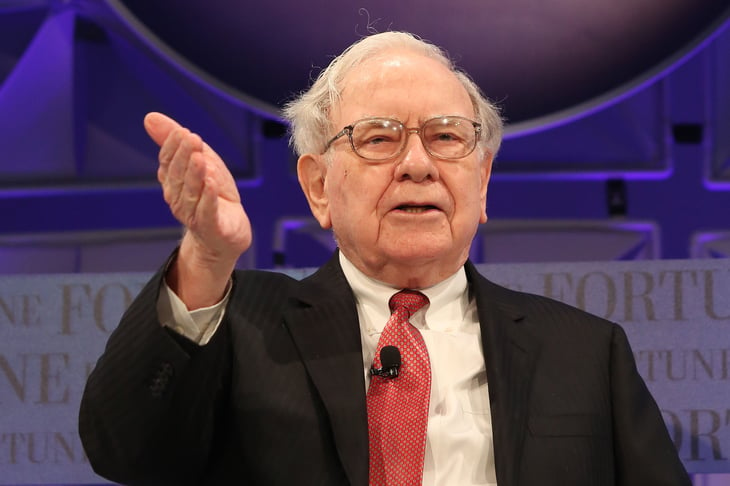

Warren Buffett

Warren Buffett might be the best investor of all time. And he’s certainly one of the great American optimists.

Every year, he writes a letter to shareholders in Berkshire Hathaway which not only covers company performance but includes tidbits of personal wisdom as well.

So, what advice does the Oracle of Omaha offer that might help during a recession? For one thing, don’t trust anyone who tells you what to buy, or worse, tries to sell you on secret knowledge. Speaking of his sister Bertie, Buffett writes: “She is sensible – very sensible – instinctively knowing that pundits should always be ignored.”

He also says:

“Speed of communication and the wonders of technology facilitate instant worldwide paralysis, and we have come a long way since smoke signals. Such instant panics won’t happen often — but they will happen.”

His point is that bad news travels faster than ever, but just because everyone else is freaking out in near-real time doesn’t mean you should panic.

Last year, at an annual meeting of shareholders, he also said this:

“Nothing is sure tomorrow, nothing is sure next year, and nothing is ever sure, either in markets or in business forecasts, or in anything else.”

And as we note in “Warren Buffett’s 2-Step Plan for Surviving a Bear Market“, perhaps his most famous saying is this: “Be fearful when others are greedy and be greedy when others are fearful.”

So prepare for the worst, ignore the experts, and don’t just copy everyone else.

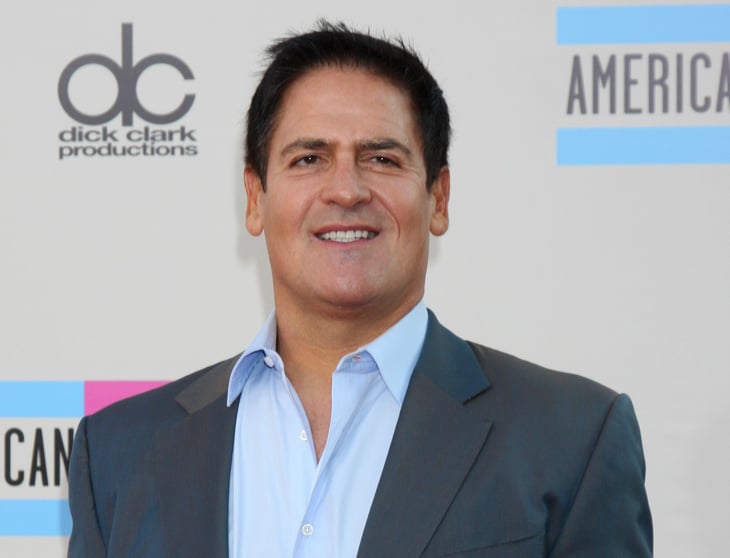

Mark Cuban

In 2019 — a few months before we entered a global pandemic — billionaire Mark Cuban offered advice for young people who could soon face their first recession.

While some bits were particular to the time — he suggested refinancing debt because interest rates were historically low — others were not. And other past advice of his applies, too.

“The greatest opportunities come when you are one of the few with cash,” Cuban says, so “save as much as you can.”

Cuban also recommends becoming indispensable at work, saying “do all you can to be great at your job” and be aware of your strengths and weaknesses. Then, use your skills to make your boss’s life easier.

“The people that tend to work for me a long time, not only are smart, not only are driven, not only are learners, but they understand that the greatest value you can offer a boss is to reduce their stress,” Cuban says.

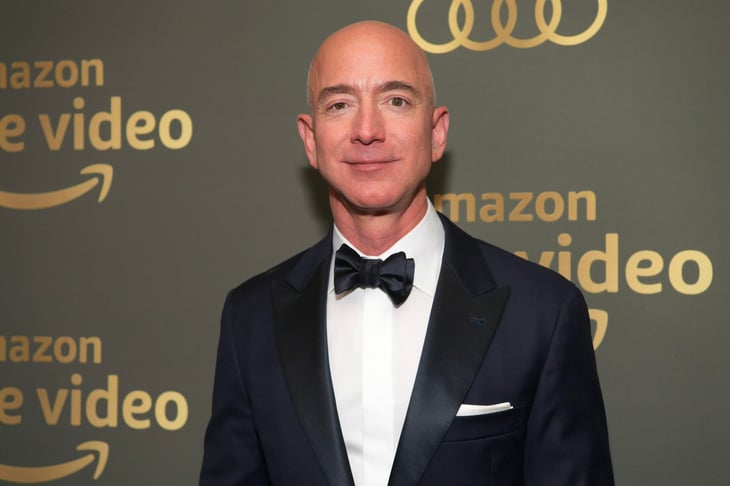

Jeff Bezos

Jeff Bezos — one of the world’s wealthiest people — also has advice. If you’re worried about a downtown, now is not the time to buy that huge new TV on Amazon or a new car.

In fact, it might be time to pull back from the stock market a bit, in anticipation of prices plummeting or of needing the money. You’ll be able to reinvest when the time is right.

Just make sure to understand how selling stocks will affect your taxes.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.