For many Americans who have yet to retire, the golden years seem further off these days.

Around 68 million workers have reconsidered their retirement timing due to the coronavirus pandemic, with about one-third of them now thinking about delaying retirement, according to a recent Edward Jones report.

Folks who are already retired might feel their golden years have lost some gleam amid the double whammy of the pandemic and ensuing recession.

These realities make retirement-related topics all the more important this presidential election cycle.

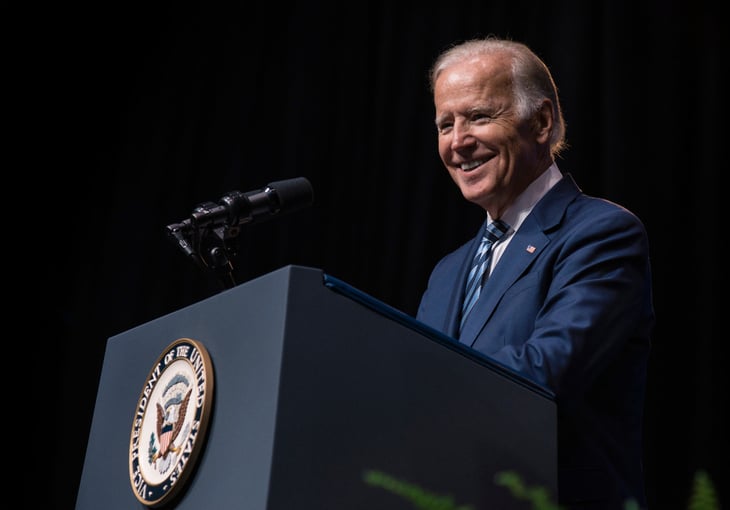

To help you better understand the stance of the challenger, former Vice President Joe Biden, we dissected proposals detailed in his official platform that could affect retirement accounts or retirees. (We intended to do the same for the incumbent, President Donald Trump, but he gives voters less information to work with in terms of a formal platform and his campaign did not respond to requests for more detail.)

Note that this article will detail Biden’s proposals that affect saving for and living in retirement, excluding his plans for Social Security. To learn about the Social Security proposals of both Biden and Trump, see “5 Ways Joe Biden Wants Social Security to Change.”

1. ‘Equalize’ retirement tax breaks

Biden’s plan: “Equalizing the tax benefits of retirement plans.”

This proposal appears to call for revamping the tax benefits of contributions to tax-deferred retirement accounts like traditional 401(k) plans. But exactly how it would do so is unclear. It is among Biden’s more vaguely described proposals, and his campaign did not respond to requests for more details about it or other proposals covered in this article.

Currently, when you put money in a tax-deferred retirement account — that is, a traditional account, rather than a Roth retirement account — you generally get a tax deduction. The value of the deduction is relative to your income tax rate.

“For example, a taxpayer in the top marginal tax bracket receives a $37 tax benefit for every $100 contributed into a retirement account,” as the Tax Foundation explains, “while a taxpayer in the bottom bracket would only get a $10 tax benefit for the same $100 contribution.”

Biden’s plan to “equalize” that tax break “across the income scale” presumably would result in taxpayers getting a more similar tax break, regardless of their income.

Biden has not specified what the percentage of the tax break would be, but a February report by the Urban-Brookings Tax Policy Center noted that giving all taxpayers a tax credit rate of 26% for retirement contributions would be “roughly revenue-neutral over the long run.”

Of course, we already have a tax credit designed to encourage lower-income households to save for retirement — the saver’s credit — as we reported in “Most Workers Don’t Know This Retirement Tax Credit Exists.”

When Biden ran for the Democratic presidential nomination in 2008, his retirement platform included expanding the saver’s credit, although there’s no mention of such a proposal on his current campaign site.

To see everything his site says about “equalizing the tax benefits of retirement plans,” here it is on a PDF.

2. Encourage more workplace retirement plans

Biden’s plan: “Giving small businesses a tax break for starting a retirement plan and giving workers the chance to save at work.”

This proposal also is part of Biden’s broader effort to “equalize saving incentives for middle-class workers.” Here’s how his campaign site explains it:

“As proposed by the Obama-Biden Administration, the Biden Plan will call for widespread adoption of workplace savings plans and offer tax credits to small businesses to offset much of the costs. Under Biden’s plan, almost all workers without a pension or 401(k)-type plan will have access to an ‘automatic 401(k),’ which provides the opportunity to easily save for retirement at work – putting millions of middle-class families in the path to a secure retirement.”

3. Expand the earned income tax credit

Biden’s plan: “Expand the Earned Income Tax Credit (EITC) to older workers.”

The earned income tax credit is a refundable tax credit for lower-income taxpayers who have earned income, meaning wages, as opposed to investment income. We break it down further in “Limits for These 2 Tax Credits Rise for 2020.”

Currently, though, the EITC is available only to taxpayers who are at least 25 years old and younger than 65 at the end of the applicable tax year.

Biden would “allow low-wage older workers to claim the tax credit” as part of an effort to “provide help for older workers who want to keep working.”

His platform does not specify what ages he means by “older workers,” though. So, it’s unclear whether Biden would broaden the qualifying age range or remove the age requisite entirely.

Also unclear is how a Biden administration would make up for the decrease in federal revenue that would result from expanding this tax credit or the tax credits on the next page of this article.

4. Expand tax credits for long-term care

Biden’s plan: “Provide tax relief to help solve the long-term care challenge.”

Long-term care can cost from $50,000 to $100,000 a year, depending on the type of care, as we report in “This Is the Best Age to Buy Long-Term Care Insurance.” What’s more, long-term care is among the expenses that Medicare generally does not cover.

Biden’s plans to help Americans with this cost include:

- “… increase the generosity of tax benefits for older Americans who choose to buy long-term care insurance and pay for it using their savings for retirement.”

- “… creating a $5,000 tax credit for informal caregivers, modeled off of legislation supported by AARP.”

To learn about other tax credits for individuals that Biden plans to expand or create, check out “7 Ways Your Taxes Could Change Under Biden.”

5. Establish ‘workplace safeguards’ for older Americans

Biden’s plan: “Protect older Americans against harmful age discrimination.”

Like the expansion of the earned income tax credit, this proposal is part of an effort to “provide help for older workers who want to keep working.”

Here’s how Biden’s platform for older Americans explains it:

“As president, Biden will back bipartisan legislation protecting older workers from being discriminated against in the workforce. According to an AARP survey, this practice is widespread – with more than 60% of older workers reporting discrimination because of their age. The Biden Plan will put in place workplace safeguards making it easier for older workers to prove that they were treated unfairly at work.”

The Biden campaign did not respond to requests for more information about this legislation or safeguards.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.