Where are you going with your money? Whatever your goal, you’ll need a plan to get there.

“A goal without a plan is just a wish,” Antoine de Saint-Exupery, the French pilot best known as the author of “The Little Prince,” is credited with saying.

October is National Financial Planning Month, a good time to give your plan an annual checkup or to get going on a plan if you have none.

Did your situation change in the last year, perhaps due to marriage, divorce, children or career? This is a good time to examine your progress and your goals, and to set new goals.

Make the following moves to help bring your goals closer to reality.

1. Get started

Most of us have just a few sources of income — jobs, interest, dividends or support payments, for example. But we have many ways to spend. That makes it tough to track your money.

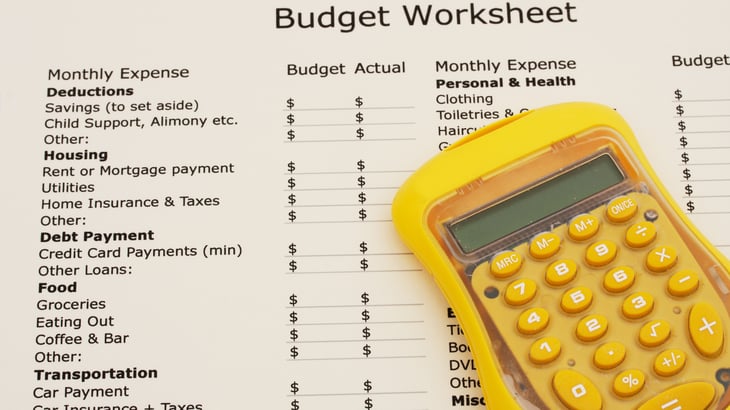

You can use spreadsheets, apps or pencil and paper to monitor the money coming in and going out. To get started, create some categories. You can add more or subtract some later, so don’t feel this has to be perfect.

Typical categories include spending on:

- Food at home or dining out

- Transportation

- Rent or mortgage

- Utilities

- Clothes

- Entertainment

- Health care

- Donations

- Paying off loans

- Credit card debt

At Money Talks News, one of our favorite tools is YNAB (You Need A Budget), an app that records and organizes your spending into categories that you create. It automatically measures progress toward your goals. (Here’s how it works.)

2. Focus on the future

How far ahead do you think about your financial situation: A week? A month? Five years? Kids’ college applications? Your retirement?

The further ahead you think, the more money you’re likely to save, one study says.

On average, people earning $50,000 a year who looked far ahead — to retirement, for instance — saved more than those making $100,000 who didn’t think much about the future, Sarah Newcomb, a behavioral economist at Morningstar, tells Money Talks News.

Ask yourself, “What do I want my life to look like one month, one year, one decade or longer from now?”

3. Pay yourself first

You can’t take care of others if you don’t take care of yourself, financial planners say.

That’s why you should have part of your paycheck routed directly to a savings account. It’s also why it’s critical to take part in your employer’s 401(k) or other retirement savings plan, if one is offered.

If you wait until you’ve paid the rent, power and cable bills, and hit the supermarket — and then maybe help your adult children or your aged parents, and splurge on dining out or clothes — it’s likely you won’t have money left for savings.

4. Build your emergency fund

If your car suffered a $400 breakdown tomorrow, would you have the cash to fix it without borrowing? What if you lost your job? Could you live on savings while finding a new job?

Many financial planners recommend building a cushion of three to six months’ worth of basic living expenses. That includes electricity, heat, water, rent or mortgage, car payments, food, insurance, debt payments, and probably internet access. But it doesn’t include theater tickets, Netflix, gym memberships or an evening at your local brewpub.

At the same time, make your emergency fund work for you. Instead of keeping that money in a savings account, where it earns so little that you lose ground to inflation, put it where it will earn at least somewhat more — a certificate of deposit, for instance, or a stock or bond mutual fund.

5. Review your insurance

Insuring against the unexpected, such as a disability or accident, doesn’t just protect your family finances. It also may help reduce the size of the emergency fund you need.

Check the cost of premiums for adequate life, health, auto, homeowners, renters and other insurance policies. The Zebra is a good comparison site for vehicle insurance. We have more tips in “New Ways to Save Money on Insurance of Every Kind.”

6. Check your credit

Credit reports affect our financial lives when we apply for mortgages, credit cards, rental housing and even jobs. Keeping an eye on your credit report also helps you spot signs of identity theft.

Your credit score deserves a look once in a while, too. Generally, the better your score, the less interest you’ll pay to borrow money.

The first step in improving your credit score is to see where you stand by checking your report, free of charge. Now through April 2022, consumers can access their free Equifax, Experian and TransUnion credit reports as often as once a week.

When you get your credit report, search for errors or discrepancies between your records and the report. If you find errors, work on getting them corrected. Find instructions for disputing errors at the websites of the three credit-reporting agencies mentioned above.

7. Review your investments

Learn more about the most common investments: stocks, bonds and cash.

Financial planners can help with planning investments. As you make your decisions, consider:

- Your risk tolerance

- Your time horizon (how much time you have to meet your goals)

- How hands-on you want to be managing investments

- Minimizing investment fees

- Diversifying your portfolio so if one sector of the economy tanks, you’ll have investments in areas that are still strong

Mutual funds and ETFs (exchange-traded funds) are safer and easier ways to own stocks. Money Talks News founder Stacy Johnson prefers index funds of stocks, like those that track the S&P 500, for higher long-term returns without the costs associated with managed funds.

If you’re already invested, check that your selections still accurately reflect your risk tolerance and time horizon.

Wondering how to diversify your investments? Stacy recommends this approach:

- Subtract your age from 100 and put the result as a percentage of your savings into an S&P 500 index fund. (If you’re 60 years old, subtracting 60 from 100 leaves 40, so put 40% of your savings into index funds.)

- Take what’s left — 60%, in this case — and put half (30%) in a cash fund, like a money market fund.

- Put the remaining 30% in a bond fund.

8. Perform a tax checkup

See if you can reduce your tax burden with these strategic year-end moves.

- Max out your traditional 401(k) or workplace retirement plan by Dec. 31. The basic limit on elective deferrals in 2021 is $19,500, the IRS says. If you are 50 or older, you can contribute an extra $6,500 for certain plans, including 401(k)s, and less for others. The IRS has the details on these catch-up contributions.

- No 401(k)? Use an IRA. In 2021, you can contribute up to $6,000 — or up to $7,000 if you are over 50 — tax-deferred, to a traditional IRA.

- Check your withholding. Use the IRS’ free Tax Withholding Estimator to do a quick “paycheck checkup.”

- Capitalize on the health savings accounts (HSAs) associated with high-deductible health insurance plans. Make sure you contribute the 2021 maximum. That’s $3,600 for individuals and $7,200 for families, plus an additional contribution of $1,000 if you are age 55 or older.

9. Trim debt

Smart habits help reduce debt and improve your finances so you can reach goals.

If you’re struggling with payments for credit cards, payday loans, pawnshops, car title loans, student loans, mortgages or other debts, there’s help in our Solutions Center.

Or choose do-it-yourself debt destruction: Make a list of your debts and pay them off according to one of these plans:

- List and pay debts by interest rate: Start with the debt with the highest rate and work down your list. This method can save you the most money.

- List and pay debts by outstanding balance: Start by paying off the smallest balance first, working your way from small to large. This lets you see progress quickly and stay motivated.

Learn more: “7 Great Tools to Help You Get Out of Debt.”

10. Look to 2022 — and beyond

Review your legal documents and beneficiary designations. Update your will and any trusts, retirement plan documents, life insurance policies and living wills. It may seem indelicate, with Christmas holidays coming up, but family gatherings can be the right time to discuss what to do if you, your parents or other loved ones can no longer make decisions.

Consider designating someone to make medical decisions and someone to have power of attorney for financial matters.

If you want to put these legal structures in place, consider the DIY approach: You can create many standard legal documents for free through the Money Talks News partner Rocket Lawyer.

11. Get the right help

A professional financial adviser can help create a path for achieving financial goals. Learn about finding a trusted adviser in this Money Talks News podcast. Some advisers specialize in retirement or estate planning. Others focus on specialized money matters — homebuying readiness, for example.

Some experts suggest choosing a fee-based adviser (they charge an hourly fee) to keep your interests at the forefront. Commission-based advisers (they charge commissions to invest your money) may have an incentive to sell specific financial products.

Another key term to look for is “fiduciary financial adviser.” Such advisers are required to put your financial interests ahead of their own. Search for “Certified Financial Planners” and verify their credentials here.

12. Educate yourself

At least once a year, ask yourself: What am I doing to establish and meet my financial goals?

“Investing isn’t rocket science,” says Money Talks News founder Stacy Johnson. You can read articles at Money Talks News to learn more about investing and managing your investments.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.